New Research Brief Examines Volatility in Metro-Area Remodeling Cycles

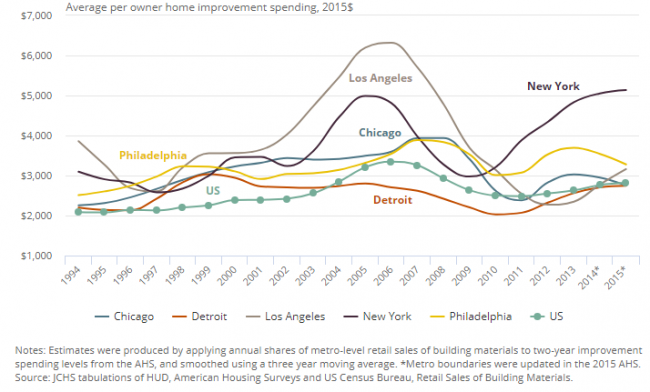

The first release in our new Improving America’s Housing research brief series, Investigating Metro-Area Home Improvement Spending Cycles, utilizes data from the 1995–2015 American Housing Surveys (AHS) and finds that national trends in the home remodeling market over the past two decades mask significant variations in spending trends at the local level. Among the major metros with consistent historical data in the AHS—including Chicago, Detroit, Los Angeles, New York, and Philadelphia—there is surprising variety in the trajectory of home improvement spending over time, with some of these metros experiencing severe booms and busts and others exhibiting much more modest changes in spending.

Major Metro Remodeling Cycles

The magnitude and timing of remodeling spending booms, busts, and recoveries in metro areas are often—but not always—highly associated with local economic and housing market conditions, such as home prices and sales. Change in home values, in particular, stands out as a strong indicator of metropolitan remodeling activity. This relationship makes practical sense since home improvements, by definition, add value to a home. When house prices (and home equity levels) are rising, owners may be encouraged to make investments in their homes, and when prices are slowing or falling, owners may be more likely to postpone making discretionary improvements. Indeed, the reasonably strong, positive correlations between metro-level home values and local improvement spending levels in each of the major metros under consideration (with correlation coefficients ranging from 0.62 in New York to 0.76 in Chicago) suggest that home values and remodeling spending tend to move in the same direction over time. Ultimately, local home price cycles may be reliably good proxies for the timing of upturns and downturns in remodeling spending cycles in the many metro areas for which historical home improvement data is unavailable.

This research also suggests a relationship between the level of per owner improvement spending and the volatility, or variability, of a metro area’s remodeling cycle, such that metros with relatively higher levels of average improvement spending by homeowners tend to also experience larger swings in expenditure levels over the course of their housing and remodeling cycles, as has been the case in New York and Los Angeles. In comparison, a metro like Detroit with relatively lower levels of average remodeling expenditure has had a much more stable remodeling cycle over the past two decades. Certainly, if this relationship holds, it would have important implications for remodeling contracting businesses looking to expand into high-spending markets that are much more prone to periods of severe boom and bust. Remodelers in more volatile markets would likely pursue very different business strategies for coping with drastically changing demand during large upturns and downturns than would remodelers operating in lower-spending, but steadier markets.

This first look at long-term remodeling cycles in some of the county’s largest metropolitan areas sheds light for understanding the likely pace, timing, and volatility of historical remodeling cycles for many more metropolitan areas around the country.

Our new Improving America’s Housing research brief series is an effort to make the work of our Remodeling Futures Program more accessible to industry members and the public. These briefs are intended to summarize research findings with a minimal amount of technical terminology, while adding more interactive charts and maps. Read the new brief and try the interactive charts, which highlight key findings about metro-area home improvement spending cycles.