Renters Struggle with Competing Costs of Food, Energy, and Housing

Lower-income renters continued to face extraordinary financial hardships in the first half of 2024, as the competing costs of food, energy, and housing made it nearly impossible for some households to cover basic needs. Between January and June of this year, one in four renter households with incomes below $25,000 reported they sometimes or often did not have enough to eat, and 26 percent regularly kept their homes at temperatures they felt were unsafe or unhealthy. In addition to making these trade-offs, 16 percent of lower-income renters were behind on their rent payments, and 7 percent felt pressure to move because they couldn’t keep up with housing costs.

Our 2024 State of the Nation’s Housing report pointed to significant affordability challenges for renters. Even though rent growth halted at the beginning of this year after a period of record-breaking increases, rental affordability is the worst on record. At last measure in 2022, the number of cost-burdened renter households reached a record high of 22.4 million. The cost burden rate for lower-income renters climbed to 83 percent, including 65 percent who were severely burdened. As rents outpaced incomes, lower-income renters had less left over after paying rent than ever before, with a median residual income of just $310 per month in 2022.

In recent months, the high cost of housing and other necessities have strained renter households’ budgets. According to tabulations of the Census Bureau’s Household Pulse Surveys conducted between January and June of 2024, 59 percent of renter households earning less than $25,000 found it somewhat or very difficult to keep up with expenses such as rent, food, car payments, medical expenses, and other necessities. Even among households earning $75,000 or more, 28 percent reported difficulties with expenses.

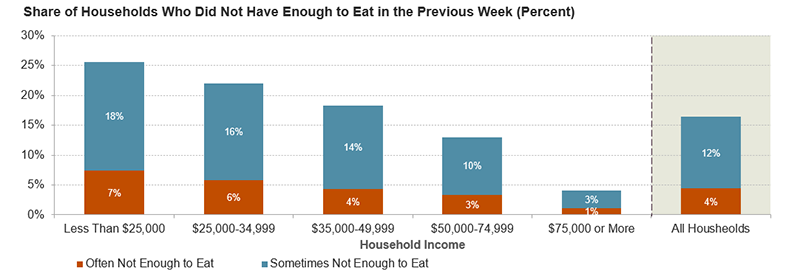

Many lower-income renter households struggled with food insufficiency (Figure 1). Among households earning less than $25,000, 26 percent reported that they sometimes or often did not have enough to eat in the previous week because they could not afford it. Households behind on rent were even more likely to experience food insufficiency. Of the 16 percent of lower-income renter households who were behind on rent in this period, 45 percent experienced food insufficiency, more than double the 21 percent of households in the same income group who were not behind on rent. Alarmingly, among lower-income renter households who experienced any degree of food insufficiency and had one or more child under 18 in their household, 30 percent reported that their children sometimes or often did not get enough to eat in the previous week because they could not afford it.

Figure 1: Over a Quarter of Lower-Income Renter Households Experienced Food Insufficiency in Early 2024

Note: Includes only households who reported they did not have enough to eat because they could not afford to buy food.

Source: JCHS tabulations of US Census Bureau, Household Pulse Surveys, Phase 4.0 and 4.1, Cycles 1-6, January 9-June 24, 2024.

Federal food assistance programs are helping households meet their nutritional needs. Just over half of renter households who earned less than $25,000 reported receiving SNAP benefits and 6 percent received WIC. Although access to assistance prevents even greater rates of food insufficiency, underfunding and inconsistent access to these critical benefits mean that many still struggle to get adequate nutrition, evident in the high reported rates of food insufficiency. Lower-income renter households who received SNAP had only slightly lower rates of severe food insufficiency, with 7 percent reporting they often did not get enough to eat, compared to the 8 percent of households in this income group who did not receive SNAP. Charities also helped fill gaps; 19 percent of lower-income renters reported receiving free groceries or a free meal from a food bank or similar place in the past week.

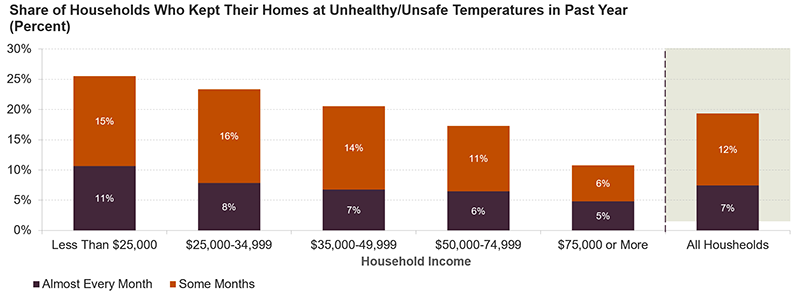

In addition to cutting back on food, lower-income renters are struggling with energy costs (Figure 2). A quarter of lower-income renters regularly had to keep their home at a temperature they felt was unsafe or unhealthy in the previous year, including 11 percent of who reported doing so almost every month. Reducing their monthly energy consumption to this extent likely enabled some households to keep up with their utility bills despite the potentially detrimental impact on well-being.

Figure 2: Many Lower-Income Renter Households Had to Keep Their Homes at Unhealthy or Unsafe Temperatures

Note: Survey question: “In the last 12 months, how many months did your household keep your home at a temperature that you felt was unsafe or unhealthy?”

Source: JCHS tabulations of US Census Bureau, Household Pulse Surveys, Phase 4.0 and 4.1, Cycles 1-6, January 9-June 24, 2024.

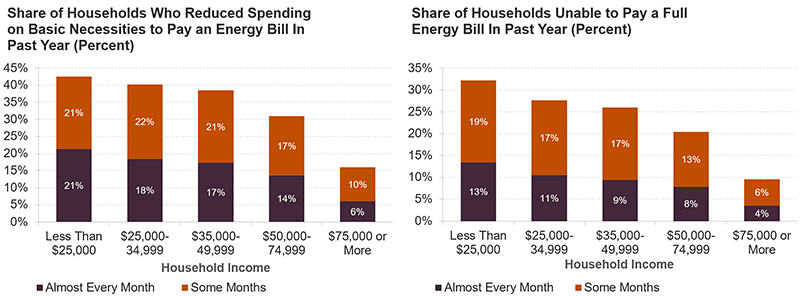

While these strategies may help some households reduce their energy bills, high energy costs still force painful spending trade-offs for many (Figure 3). In total, 43 percent of lower-income renter households regularly had to reduce or forego spending on basic household necessities such as food and medicine to keep up with energy bills, with 21 percent making this trade-off almost every month. In addition, 32 percent of renter households in this income group couldn’t pay their energy bills in some or almost every month in the past year.

Figure 3: Renters Struggled to Keep Up with Energy Bills

Note: Survey question: “In the last 12 months, how many months did your household reduce or forego expenses for basic household necessities, such as medicine or food, in order to pay an energy bill?”

Source: JCHS tabulations of US Census Bureau, Household Pulse Surveys, Phase 4.0 and 4.1, Cycles 1-6, January 9-June 24, 2024.

Many of these financial hardships are overlapping; in total, 40 percent of lower-income renter households reported hardships related to food insufficiency, unsafe temperatures, or both. Among lower-income renters, 15 percent experienced food insufficiency alone, 15 percent only kept their homes at unsafe temperatures, and 11 percent experienced these hardships simultaneously.

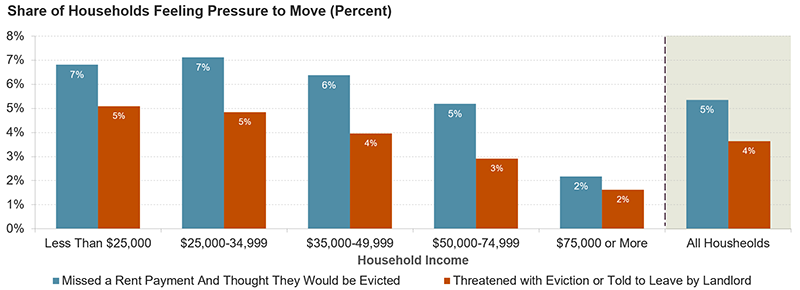

Even with these trade-offs, some lower-income households continued to fall behind on rent and felt pressure to relocate (Figure 4). Among renter households earning less than $25,000, 16 percent were behind on rent payments. Seven percent reported they felt pressure to move in the last six months because they had missed a rent payment and thought they would be evicted, and 5 percent felt pressure to move due to being threatened with eviction or told to move by their landlord.

Figure 4: Households Feel Pressure to Relocate Due to Missed Rent Payments and Eviction Risk

Note: Survey question: “Thinking of all the places you’ve lived during the last six months, did you ever feel pressure to move due to any of the following reasons?”

Source: JCHS tabulations of US Census Bureau, Household Pulse Surveys, Phase 4.0 and 4.1, Cycles 1-6, January 9-June 24, 2024.

Despite a broader economic recovery, renters made significant sacrifices to their well-being to pay the bills in the first half of 2024, and some simply do not have the resources to keep up with expenses whether they make these trade-offs or not. Our previous research found that nearly all lower-income renter households lack the income needed to cover their essential expenses after paying rent. An adequate and holistic safety net that addresses these overlapping and compounding challenges is crucial to ensure households can meet their basic needs.