How Many Young Homebuyers Get Support from Their Parents and How Much of a Difference Does It Make?

Rising house prices, increased interest rates, stricter underwriting standards, and significant student loans and credit-card debt have made it harder for younger would-be homeowners to build up savings needed for down payments and closing costs. While these constraints have stymied some would-be owners, others have overcome them by getting financial help from their parents.

To date, however, there has been little detailed research on the nature, extent, and size of these transfers. However, in “The Role of Parental Financial Assistance in the Transition to Homeownership by Young Adults,” a new paper in the Journal of Housing Economics, my colleagues and I used data from the Health and Retirement Survey (HRS) and the Panel Study of Income Dynamics (PSID) to examine the prevalence of intergenerational financial transfers and how they seem to affect home buying decisions. We found that such transfers are more than a little, and that they increase the probability of home purchase among adult children, even after controlling for parental wealth and other characteristics of parents and children. Moreover, this relationship was relatively more pronounced in the years following the recession, when borrowing constraints increased.

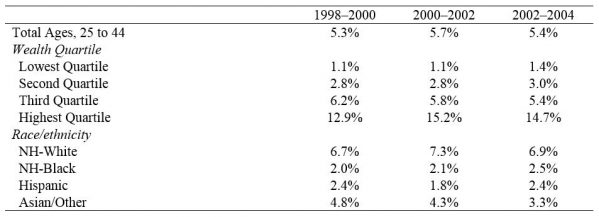

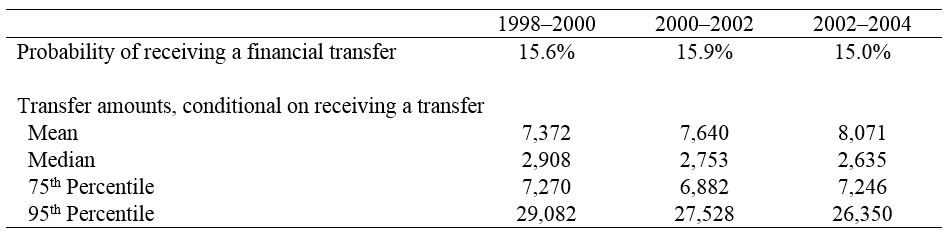

Using the HRS, we began our analysis by measuring the probability that an adult between the ages of 25 and 44 received financial assistance from his/her parents between survey years, 1998–2000, 2000–2002, and 2002–2004. (HRS does not include the homeownership questions for re-interviewed households beginning in 2006, so the analysis sample ends with the 2004 wave.) As Table 1 shows, the HRS data suggests that intergenerational transfers are not unusual. Rather, the likelihood of a transfer ranged from 15.0 to 15.9 percent depending on survey year. In addition, the data indicate that among those who received a financial transfer, the distribution of transfer amounts is skewed towards higher values, making the mean value ($7,400 to $8,100) nearly three times larger than the median ($2,600 to $2,900).

Table 1. Probability and Amounts of a Household Aged 25 to 44 Received Parental Financial Assistance

Note: For the transfer probability, the sample is restricted to adult children between ages 25 and 44 at the beginning of interval. For the descriptive statistics for transfer amounts, the sample is restricted to adults between 25 and 44 who received at least $500 over a two-year period. All figures are in 2015 dollars.

Source: 1998-2004 RAND HRS family data file.

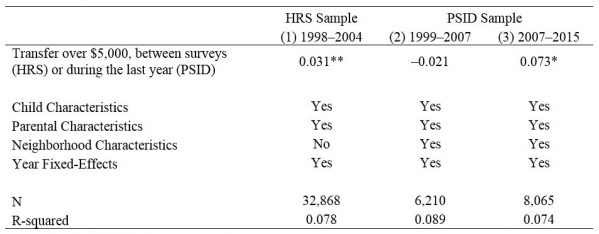

Next, we examined the extent to which receipt of a transfer is associated with home purchase during the same period after controlling for a variety of socioeconomic characteristics of children and parents. As Table 2 shows, the model using the HRS data indicates that young adults who received a transfer of at least $5,000 from their parents were 3.1 percentage points more likely to become homeowners, after controlling for other factors (Model 1).

Because the HRS sample is limited to the years from 1998 to 2004, we repeated the analysis using the 1999–2015 PSID, which has a smaller sample size but covers a more recent period of time. Our analysis of the PSID data found that the relationship between receipt of a parental transfers and home purchase was not statistically significant in the pre-recession period from 1999 to 2007 (Model 2). However, during the post-recession period from 2007 to 2015, receipt of a parental transfer of more than $5,000 increased the probability of home purchase by 7.3 percentage points among households headed by 25-44-year-olds (Model 3), a finding that is consistent with those found in previous studies.

Table 2. The Effect of Transfer on Homebuying Estimated by Linear Probability Regression

Note: *: p < 0.05, **: p < 0.01, ***: p < 0.001. The sample is restricted to householders who are (1) between the ages of 25 and 44, (2) not owners at the beginning of the interval, and (3) observed at the end of the two-year interval. All child and parental characteristics are those observed at the beginning of the two-year interval. The cash transfers between surveys are reported at the year before each survey. Standard errors are clustered at individual level.

What do these findings mean? Of course, correlation is not causality: even with extensive controls, there might be some unobserved variables (e.g., the parent-child relationship) that can affect both homeownership and financial assistance, leading our analysis to under- or overestimate the effects of financial transfers. That said, as Table 3 shows, parental transfers reduced the barriers to homeownership for children of parents who had the resources to make a transfer. Given existing disparities in wealth across racial/ethnic and socio-economic groups, this finding highlights the potential for parental transfers to perpetuate continue racial, ethnic, and socio-economic disparities in both wealth and homeownership rates for some time to come.