California’s Homeowners Insurance Market is a National Bellwether

With rebuilding efforts underway in Los Angeles following January’s devastating Palisades and Eaton fires, the scale of damages and recovery needs in impacted communities are coming into focus. Along with the loss of 29 lives, the wildfires and ensuing urban conflagrations damaged an estimated 18,000 structures — including approximately 11,300 homes, nearly 90 percent of which were destroyed. Estimated total economic losses are approximately $52.5 billion, making the fires some of the costliest in US history. Amid the current landscape of housing costs far above the national average and increasingly severe wildfires fueled by climate change, California faces the difficult task of meeting both housing affordability and insurability objectives. What brought us here?

Two signs of instability in private residential insurance markets are sharply rising insurance premiums and nonrenewal rates. Evidence from a recent Federal Insurance Office (FIO) report shows average homeowners insurance premiums in the private market nationwide rose 8.7 percent above inflation between 2018 and 2022. The study finds premiums and nonrenewal rates are significantly higher in ZIP codes with relatively high expected losses from climate-related perils.

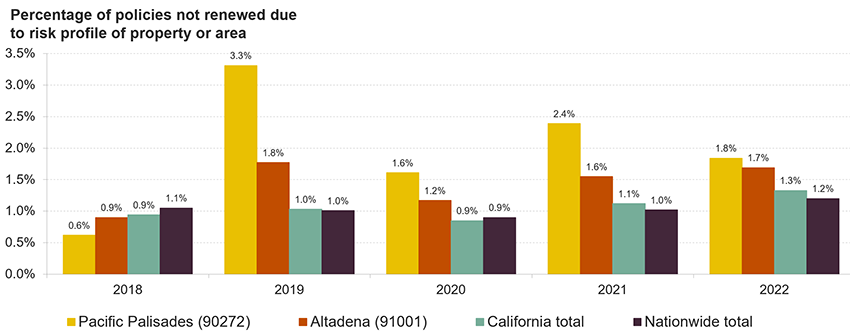

An examination of the FIO report’s data in ZIP codes affected by the Eaton and Palisades fires suggests the private residential property insurance market in these areas showed warning signs leading up to the fires. Figure 1 displays nonrenewal rates from 2018 to 2022 in the ZIP codes in Altadena (91001) and Pacific Palisades (90272) which saw the greatest number of structures damaged during the fires. In both ZIP codes, nonrenewal rates rose above the California-wide and nationwide averages in the years leading up to the fires.

Figure 1: Homeowners Insurance Nonrenewal Rates in Acutely Fire-Affected Areas Rose Above State and National Averages

Sources: JCHS tabulations of December 2024 US Senate Budget Committee “Next to Fall” report data (California totals); US Treasury Department Federal Insurance Office PCMI data (ZIP code and nationwide totals). “Analyses of U.S. Homeowners Insurance Markets, 2018-2022: Climate-Related Risks and Other Factors.” January 2025.

Figure 2 interactively displays California-wide ZIP code-level data on private homeowners insurance premiums and nonrenewal rates between 2018 and 2022. The average annual homeowners insurance premium in Pacific Palisades rose 33 percent above inflation, from $5,025 to $6,689, while in Altadena the average premium rose 26 percent above inflation, from $1,485 to $1,873.

Figure 2: California Homeowners Insurance Premiums and Nonrenewal Rates, 2018–2022

View larger interactive map (best viewed in Google Chrome)

Source: US Treasury Department Federal Insurance Office PCMI data (ZIP code and nationwide totals). “Analyses of U.S. Homeowners Insurance Markets, 2018–2022: Climate-Related Risks and Other Factors.” January 2025.

Note: ZIP Code Tabulation Areas correspond to 2022 U.S. Census Bureau boundaries.

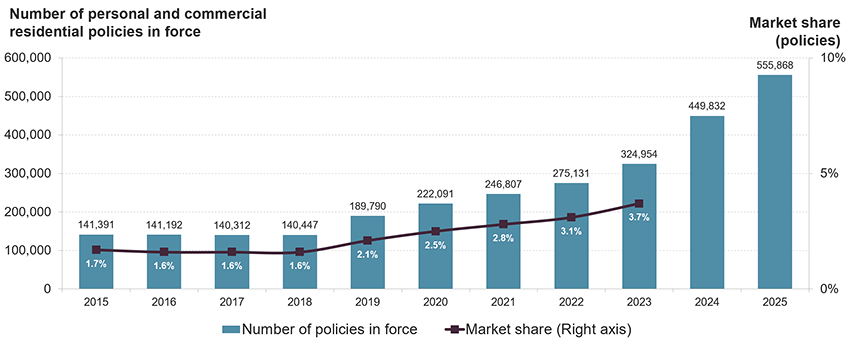

If property insurance options in the private market are limited or non-existent, property owners may seek coverage in their state’s residual market, sometimes called the “insurer of last resort.” In California, the Fair Access to Insurance Requirements (FAIR) Plan writes policies in the residual market. Figure 3 shows the number of residential policies in California’s FAIR Plan has nearly quadrupled since 2015, reaching a historic high of more than half a million in March 2025. The substantial growth in both the number of residential policies and amount of coverage written by the FAIR Plan reflects limited availability of affordable residential insurance options in the private market.

Figure 3: California’s Fair Access to Insurance Requirements (FAIR) Plan Is Experiencing Historic Growth and Financial Stress

Sources: California FAIR Plan; 2024 data represent total from September 2024 while 2025 data represent total from March 2025.

Note: Market share information not yet available for 2024 and 2025.

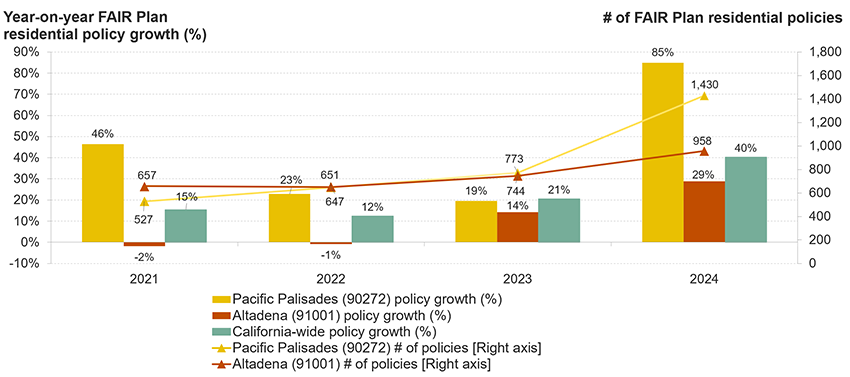

Leading up to the Eaton and Palisades fires, a growing number of residential policyholders in fire-affected areas sought coverage from the FAIR Plan. Figure 4 shows the growth in the number of FAIR Plan residential policies in Pacific Palisades and Altadena from 2021–2024, compared to the statewide average. In Pacific Palisades, the annual growth rate was well above the statewide average, and the number of FAIR Plan residential policies in these two ZIP codes more than doubled, from 1,184 to 2,388.

Figure 4: Before Eaton and Palisades Fires, a Growing Number of Residential Policies Moved Into FAIR Plan in Fire-affected ZIP Codes

Sources: California FAIR Plan; Microsoft AI For Good Lab.

Note: Fire-affected ZIP codes include 90265, 90272, 90290, 90402, 91001, 91024, 91103, 91104, 91107.

In the month following the fires, the California FAIR Plan received approximately 5,000 claims for associated damages. To avert insolvency from its estimated $4 billion in total losses, the FAIR Plan will assess $1 billion in emergency fees on member insurers this year. Half of these fees can be passed on to a broad range of policyholders, meaning costs from the Eaton and Palisades fires will be borne by private insurers and policyholders across the state. The California FAIR Plan’s first emergency assessment in more than three decades highlights the historic nature of the January fires and financial fracture lines in the state’s residential property insurance market. California’s insurance commissioner recently reaffirmed the state is in a “statewide insurance crisis” and approved a 17 percent rate increase for homeowners insurance policies written by State Farm, the state’s largest writer of homeowners insurance. Such rate increases incentivize private insurers to continue to do business in the state, though higher premiums will worsen housing affordability challenges.

As tens of billions of dollars from insurance claims and federal disaster relief funds fuel rebuilding efforts in Los Angeles, evidence from past fire disasters suggests the road to recovery will be long and uneven. Weather- and climate-related disasters tend to decrease housing supply and increase rents. Local officials are incentivized to preserve their jurisdiction’s population and tax base, while residents support strengthening building codes and land use restrictions in hazard-prone areas. In the wake of the fires, Los Angeles mayor Karen Bass authorized expedited permitting and limited environmental review to “clear the way to rebuild homes as they were,” highlighting tradeoffs between meeting short-term housing needs and long-term climate resilience goals.

As Los Angeles rebuilds, incentivizing physical risk reduction will be the primary way to guarantee insurability and reduce future losses. At the property level, risk mitigation measures can be integrated into retrofitting or rebuilding efforts to achieve insurance cost savings and avoid damages in the longer term. For example, adopting resilient roofs, doors, windows, fences, and landscaping practices can mitigate future wildfire losses. Indeed, these measures can save money over time through avoided losses or insurance discounts. In California and other states, insurance regulators require insurance premium discounts for specific home mitigation actions. Innovative product solutions such as climate endorsements in residential insurance policies can further incentivize incorporation of climate-resilient features into homes rebuilt with insurance claims payouts.

With the fire and hurricane seasons on the horizon, residents will benefit from understanding their property’s potential hazard risks, insurance policy details, and mitigation opportunities. These efforts will be helpful on the road to longer-term resilience, insurability, and affordability. As we manage new risks, some old lessons will still apply: an ounce of prevention is worth a pound of cure.