Slight Gains in 2023 Outlook for Residential Remodeling

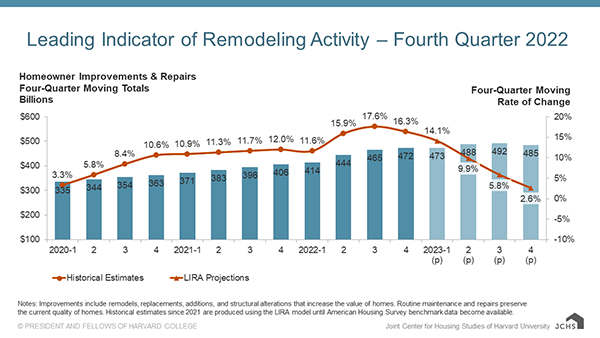

After several years of double-digit gains, expenditures for improvements and repairs to the owner-occupied housing stock are expected to grow only modestly in 2023, according to the Leading Indicator of Remodeling Activity (LIRA) released today by the Remodeling Futures Program at the Joint Center for Housing Studies of Harvard University. The LIRA projects a steep deceleration in annual gains of home renovation and maintenance spending from 16.3 percent at the close of 2022 to just 2.6 percent by year-end 2023.

“Slowdowns in existing home sales, house price appreciation, and mortgage refinancing activity coupled with growing concerns for a broader economic recession will cool home remodeling activity this year,” says Carlos Martín, Project Director of the Remodeling Futures Program at the Center. “Homeowners are likely to pull back on high-end discretionary projects and instead focus their spending on necessary replacements and smaller projects in the immediate future.”

Yet, the release of new benchmark data from the American Housing Survey recalibrates the overall market size. “The massive pandemic-induced changes in housing and lifestyle decisions fueled remodeling and repair spending in 2020 and 2021, growing 23.8 percent over these two years compared with the 12.5 percent originally estimated,” says Abbe Will, Associate Project Director of the Remodeling Futures Program. “While the pace of expenditures is expected to slow substantially this year, we’ve raised our projection for the remodeling market size in 2023 by about $45 billion, or 10.2 percent, to $485 billion.”

Read more about the newly released benchmark data and changes to the projected LIRA market size.

Click image for full-size chart.

The Leading Indicator of Remodeling Activity (LIRA) provides a short-term outlook of national home improvement and repair spending to owner-occupied homes. The indicator, measured as an annual rate-of-change of its components, is designed to project the annual rate of change in spending for the current quarter and subsequent four quarters, and is intended to help identify future turning points in the business cycle of the home improvement and repair industry. Originally developed in 2007, the LIRA was re-benchmarked in April 2016 to a broader market measure based on the biennial American Housing Survey.

The LIRA is released by the Remodeling Futures Program at the Joint Center for Housing Studies of Harvard University in the third week after each quarter’s closing. The next LIRA release date is April 20, 2023.

The Remodeling Futures Program, initiated by the Joint Center for Housing Studies in 1995, is a comprehensive study of the factors influencing the growth and changing characteristics of housing renovation and repair activity in the United States. The Program seeks to produce a better understanding of the home improvement industry and its relationship to the broader residential construction industry.

The Harvard Joint Center for Housing Studies advances understanding of housing issues and informs policy. Through its research, education, and public outreach programs, the Center helps leaders in government, business, and the civic sectors make decisions that effectively address the needs of cities and communities. Through graduate and executive courses, as well as fellowships and internship opportunities, the Center also trains and inspires the next generation of housing leaders.

Contact: Kerry Donahue, 617-495-7640, [email protected]