Homeownership Rates Drop to Historic Lows; Middle Class Feels the Strain of Rising Rents

Cambridge, MA - The fledgling U.S. housing recovery lost momentum last year as homeownership rates continued to fall, single-family construction remained near historic lows, and existing home sales cooled, concludes The State of the Nation’s Housing report released today by the Joint Center for Housing Studies of Harvard University. In contrast, rental markets continued to grow, fueled by another year of large increases in the numbers of renter households. However, with rents rising and incomes well below pre-recession levels, the U.S. is also seeing record numbers of cost-burdened renters, including more renter households higher up the income scale.

“Perhaps the most telling indicator of the state of the nation’s housing is the drop in the homeownership rate to just 64.5 percent last year,” says Chris Herbert, managing director of the Joint Center for Housing Studies. “This erases nearly all of the increase from the previous two decades. In fact, the number of homeowners fell for the eighth straight year, and the trend does not appear to be abating.”

The flip side of falling homeownership rates has been exceptionally strong demand for rental housing, with the 2010s on pace to be the strongest decade for renter growth in history. While soaring demand is often attributed to the millennials’ preference to rent, households aged 45–64 in fact accounted for about twice the share of renter growth as households under the age of 35. Similarly, households in the top half of the income distribution, although generally more likely to own, contributed 43 percent of the growth in renters.

The other byproduct of this surge in rental demand is that the national vacancy rate fell to its lowest point in nearly 20 years. Given the limited supply of rental units, rents rose at a 3.2 percent rate last year—twice the pace of overall inflation. “To meet this demand, construction started on more multifamily units in 2014 than in any year since 1989,” says Daniel McCue, a senior research associate at the Joint Center, “And if job growth continues to pick up, we could see even more demand, as young adults increasingly move out of their parents’ homes and into their own apartments.”

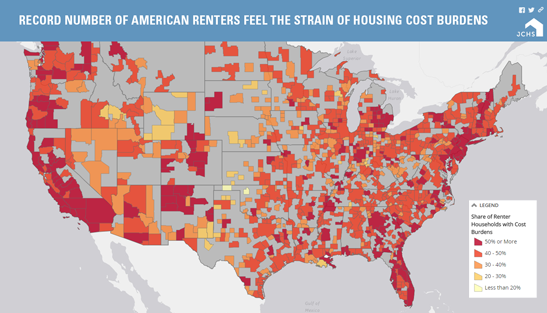

Even before the Great Recession, the number of cost-burdened households (those paying more than 30 percent of income for housing) was on the rise. But while the cost-burdened share of homeowners began to recede in 2010 (because some homes were lost to foreclosure, and low interest rates helped other homeowners reduce their monthly costs), the cost-burdened share of renters has held near record highs. In 2013, almost half of all renters had housing cost burdens, including more than a quarter with severe burdens (paying more than 50 percent of income for housing).

But perhaps most troubling, cost burdens are climbing the income ladder, affecting growing shares of not just low-income renters but moderate- and middle-income renters as well. The cost-burdened share of renters with incomes in the $30,000–45,000 range rose to 45 percent between 2003 and 2013, while one in five renters earning $45,000–75,000 are now cost-burdened as well. “While affordability for moderate income renters is hitting some cities and regions harder than others, an acute shortage of affordable housing for lowest-income renters is being felt everywhere,” says Herbert. “Between the record level of rent burdens and the plunging homeownership rate, there is a pressing need to prioritize the nation’s housing challenges in policy debates over the coming year if the country is to make progress toward the national goal of secure, decent, and affordable housing for all.”

Media Kit

- Press Release (pdf)

- Key Facts (pdf)

- Report Cover Image (png)

- Follow on Twitter: @Harvard_JCHS | #harvardhousingreport

Interactive Maps

Our latest interactive maps show that a record number of American renters are feeling the strain of housing cost burdens.

Live Webcast Release: Wednesday, June 24 @ Noon (ET)

The State of the Nation’s Housing 2015 will be released by live webcast from the Ford Foundation in New York on Wednesday, June 24 at Noon (Eastern). The webcast will feature a panel discussion and viewers will be able to tweet questions using the hashtag #harvardhousingreport to the panelists:

Jim Zarroli, Reporter, National Public Radio (moderator)

Don Chen, Director, Metropolitan Opportunity, Ford Foundation

Lynn Fisher, VP of Research and Economics, Mortgage Bankers Association

Chris Herbert, Managing Director, Harvard Joint Center for Housing Studies

Celia Smoot, Director of Housing, Local Initiatives Support Corporation (LISC)

Paul Weech, President and CEO, NeighborWorks America

Interview requests or additional information, please email [email protected] or call 617-495-7640