This Year, Half as Many Black Households Can Afford a Home as Last Year

Surging home prices and rising mortgage rates that have made it harder for all renters to become homeowners have had a particularly dramatic impact on Black renters. Indeed, the share of Black renter households who can afford the median-priced home in the US has fallen by more than half, while the share of all renter households who could afford the median-priced home fell by 44 percent. As home prices and interest rates rise, increasing the supply of affordable homes and providing income supports for low- and moderate-income households will be a key step in preserving affordable homeownership for millions of households.

As our recent State of the Nation’s Housing report highlighted, low interest rates in 2020 and throughout most of 2021 helped many first-time homebuyers qualify for mortgages while also providing current owners a chance to reduce their monthly mortgage payments through refinancing. During this time period many Black households took advantage of low interest rates to purchase homes; the homeownership rate for Black households grew 0.6 percent from Q1 2020 to Q1 2022, to 45.3 percent, twice the 0.3 percentage increase for white households. However, these modest homeownership gains may be in jeopardy.

From April 2021 to April 2022, interest rates surged by nearly 2.0 percentage points from 3.06 to 4.98 percent. This increase resulted in total monthly payments (mortgage payments plus estimated property tax and insurance costs) on the median-priced home increasing by 35 percent, from $2,100 in April 2021 to $2,800 in April 2022. In April 2021, a household had to earn at least $79,570 a year to afford payments on the median-priced home of $340,700. One year later, the income requirement stood at $107,500 for the median-priced home of $401,700. This change resulted in 4 million fewer renter households who could afford a median-priced home.

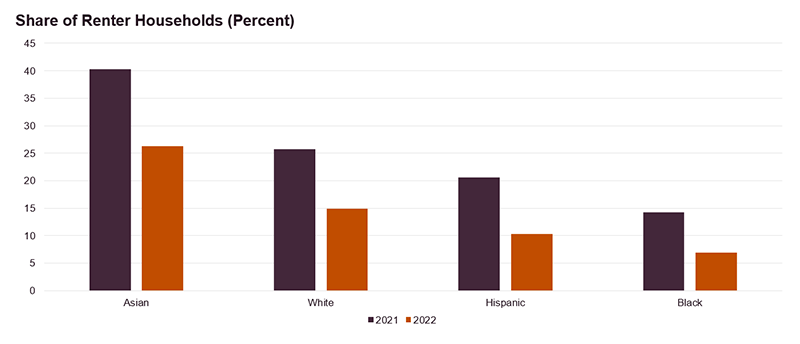

Home price and interest rate increases over the last year cut the number of Black households who could afford a home in half (Figure 1). Indeed, the number of Black renter households who could afford the median-priced US home declined from over 1.2 million to just under 600,000 Black renter households, a 52 percent decline. In April 2021, 14.2 percent of all Black renter households could afford a home and by April 2022 just 6.9 percent of all Black renter households could afford the median-priced home. While Black renter households were not the only group to face declining affordability, the share of Black renter households who could afford the median-priced home declined most by race/ethnicity.

Figure 1. Share of Renter Households Who Could Afford Median-Priced US Home, by Race/Ethnicity

Notes: Estimates assume a 3.5% downpayment on a 30-year fixed-rate loan with zero points, 0.85% mortgage insurance, 1.15% property taxes, 3% closing costs, and a maximum 31% debt-to-income ratio.

Source: JCHS tabulations of Freddie Mac, Primary Mortgage Market Surveys: NAR, Existing Home Sales.

For instance, the number of Hispanic renter households who could afford the median-priced US home declined 50 percent from 1.8 million to 900,000 over the time period (Figure 2). White renter households who could afford the median-priced home declined from 5.9 to 3.4 million renter households, a drop of 42 percent. Asian renter households had the smallest decline in affordability decreasing by 35 percent from 986,000 to 642,000 renter households. As a result, 20.6 percent of Hispanic renter households could afford a home in 2021, but by 2022 just 10.3 percent could. For white renter households, 25.8 percent could afford a home in 2021 and by 2022 just 14.9 percent could, and 40.3 percent of Asian renter households could afford the median-priced home in 2021, while just 26.3 percent could by 2022.

Figure 2. Number of Renter Households with Income at or above $79,570 and $107,500

| Renters with Incomes at or Above $79,570 | Renters with Incomes at or Above $107,500 | ||

|---|---|---|---|

| Race/Ethnicity | # of Renters | Race/Ethnicity | # of Renters |

| White | 5,862,088 | White | 3,386,041 |

| Hispanic | 1,786,380 | Hispanic | 891,938 |

| Black | 1,229,058 | Black | 595,426 |

| Asian | 986,115 | Asian | 642,448 |

Source: JCHS tabulations of American Community Survey data.

Expansion of the housing supply and development of moderately-priced housing, in addition to income supports for low-to-moderate income households will be pivotal in preserving affordable homeownership for all. Developing the policies and practices to meet this need will take concerted efforts by both the public and private sectors. The Biden administration’s Housing Supply Action Plan makes a good start with a blueprint for reducing the severe shortfall in affordable housing. At the same time, states such as California and Oregon provide examples of how to reform land use regulations to help expand the supply of more modestly-priced units. Targeted downpayment assistance would provide crucial financial support for many first-generation homebuyers who can’t afford escalating downpayment amounts. However, federal and state policymakers must act fast: if home prices and interest rates continue to rise, even more renter households will be unable to become homeowners.