Rebuilding from 2017’s Natural Disasters: When, For What, and How Much?

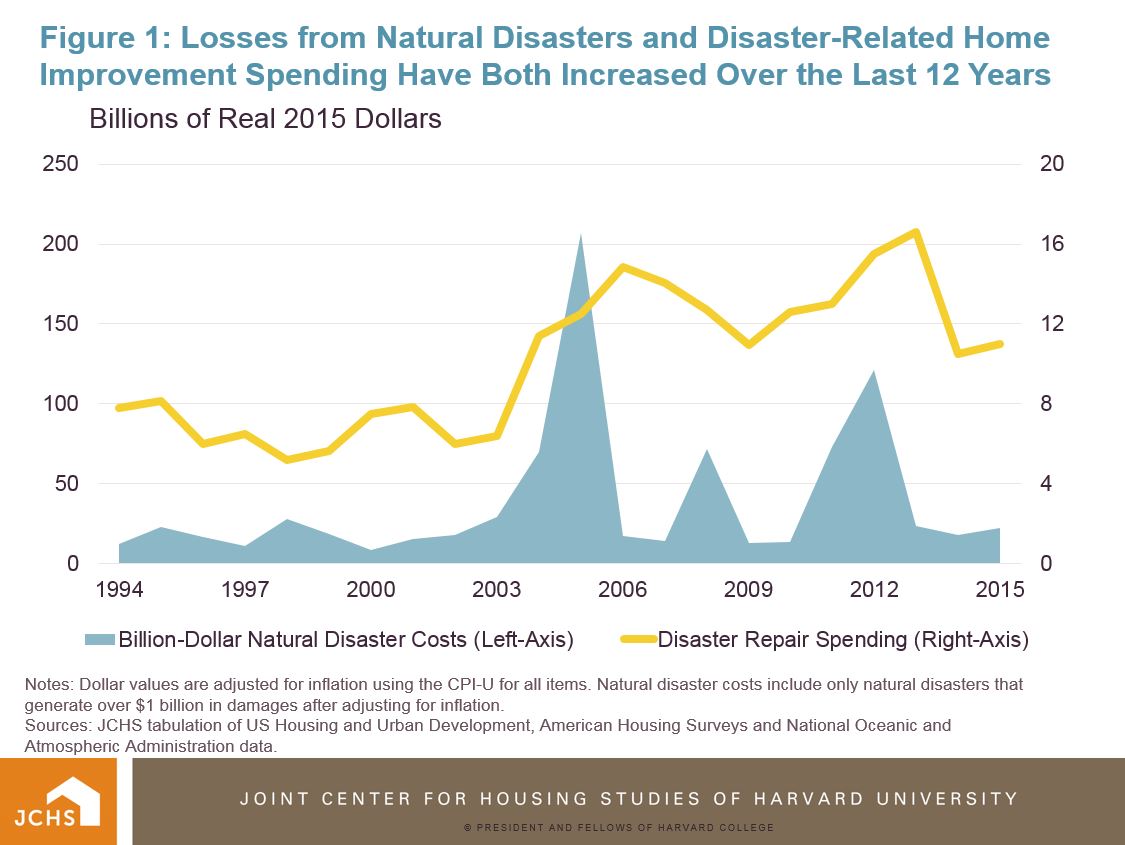

The bulk of repairs to homes damaged by this year’s record-setting disasters will not be done until 2019 or 2020, according to our analysis of post-disaster spending between 1994 and 2015. The analysis, which looked at the estimated annual cost of natural disasters alongside annual estimates of disaster-related home repairs and improvements, suggests that an increase of $10 billion in total disaster losses any time in the previous three years is associated with about $300 million in additional annual spending on disaster-related home repairs and improvements.

Sources: JCHS tabulation of US Housing and Urban Development, American Housing Survey, and National Oceanic and Atmospheric Administration data.

The finding is significant because 2017 was an unusually destructive year. While inflation-adjusted, disaster-related damages averaged about $40 billion a year between 1994 and 2015, Hurricanes Harvey, Irma, and Maria together caused about $150 billion in damages, according to estimates from CoreLogic and Moody’s Analytics (Figure 1). Moreover, damages from 2017’s winter storms, droughts, and wildfires will push these numbers even higher. In fact, the total cost of 2017’s disasters could exceed damages from any year in the last two decades, including 2005, the previous record year, when Hurricanes Katrina and Rita (and a host of smaller but significant disasters) combined to cause more than $200 billion in damages (in inflation-adjusted dollars).

As in other years that were marked by particularly destructive storms and other disasters, this year’s damages should lead to a spurt in construction activity. Some of it will be construction of and renovations to infrastructure and commercial buildings. Some will be the construction of new single-family homes and multifamily housing units. And some will be disaster-related repairs and improvements to both owner-occupied and rental housing.

To estimate how much will be spent on post-disaster home repairs, and when that spending is likely to occur, we combined information on disaster-related damages reported by the National Oceanic and Atmospheric Administration (NOAA) with data on disaster-related home repairs and improvements for the same years found in the U.S. Census Bureau’s American Housing Survey (AHS). The AHS, as a survey of households, only asks owners to report spending on their homes. The comparison suggests that renovation spending continues to increase for about two to three years after the natural disaster occurs, and that an increase of $10 billion in disaster losses any time over the prior three years generates about $300 million in additional disaster-related home improvement spending during the year studied. If this pattern holds, the bulk of the spending from 2017 losses won’t occur until 2019 or 2020. But when it occurs, there is likely to be a substantial increase in spending on home renovations in those years.

While the delay between disaster losses and repair expenditures may seem unusually lengthy, it is consistent with a study funded by the U.S. Department of Housing and Urban Development (HUD) that examined the rebuilding that took place following Hurricanes Katrina and Rita. In a recent Joint Center blog on that study’s implications, our colleague Jonathan Spader (who worked on the initial HUD study) reported that only 70 percent of hurricane-damaged properties in Louisiana and Mississippi had been rebuilt by early 2010, five years after the storms. The study further found that 74 percent of owner-occupied homes had been rebuilt, compared to only 60 percent of the rental properties.

The delays are due to many factors. Insurance companies need to assess the extent of the damage and determine how much is covered. Home improvement contractors, stretched to the limit and suffering from a labor squeeze, must delay certain projects. Owners have to consider local housing and labor market conditions to determine if repairs or improvements make financial sense. Often, federal, state, and local government entities may slow down rebuilding while they decide whether it’s feasible and, if so, whether building codes and insurance guidelines should be more stringent.

Nevertheless, spending will occur and, when it does, it can be substantial. Illustratively, in 2015 (which came after a few relatively mild years for disasters) spending on disaster-related home renovations accounted for almost $11 billion of the $220 billion spent nationally improving owner-occupied homes according to the 2015 AHS. (Lightning and fires accounted for $2.4 billion of this spending, floods for $2.0 billion, and tornados and hurricanes for $1.6 billion. Winter storms, thunderstorms, earthquakes, and drought accounted for the remainder.)

In short, 2017’s hurricanes and other disasters are likely to result in substantial spending on rebuilding, repairs, and improvements to disaster-damaged homes. Moreover, while that spending will ramp up slowly, it is likely to stretch into next decade.