Projection: US Will Add 25 Million Households by 2035

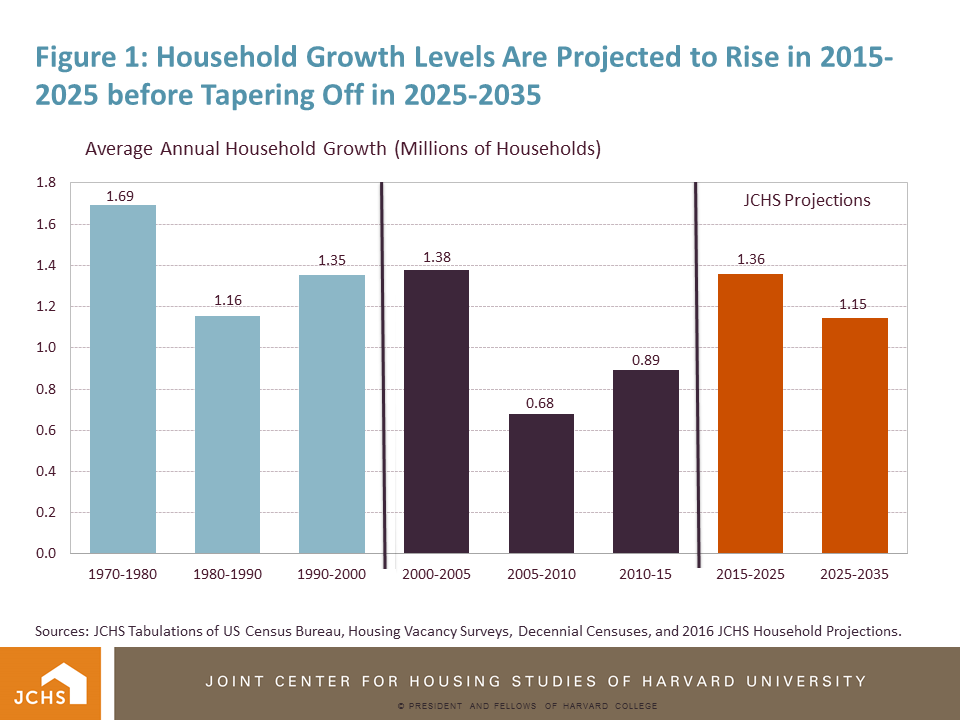

The United States will add 13.6 million households between 2015 and 2025 and another 11.5 million households between 2025 and 2035, according to Updated Household Projections, 2015-2035: Methodology and Results, a new Joint Center working paper. This growth represents an increase from the past decade that is in line with historic rates of growth seen in the 1990s, but still well below the levels experienced in the 1970s (Figure 1). An addendum to the paper indicates that the projected growth in households could lead to continued growth in residential construction activity.

The new household projections incorporate newer population projections from the US Census Bureau that are substantially larger than the Bureau’s 2012 population projections used in our 2013 estimates of household growth, which projected that the U.S. would add 12.4 million households between 2015 and 2025 and 10.35 million households between 2025 and 2035. Our new household projections also make methodological changes related to headship rates—the ratio of households to people—designed to reflect the fact that shifts in headship rates have significantly impacted household growth over the past decade. (As the paper discusses in more detail, rather than continuing the Joint Center’s recent practice of holding current headship rates constant, the new estimates use trended headship rates.)

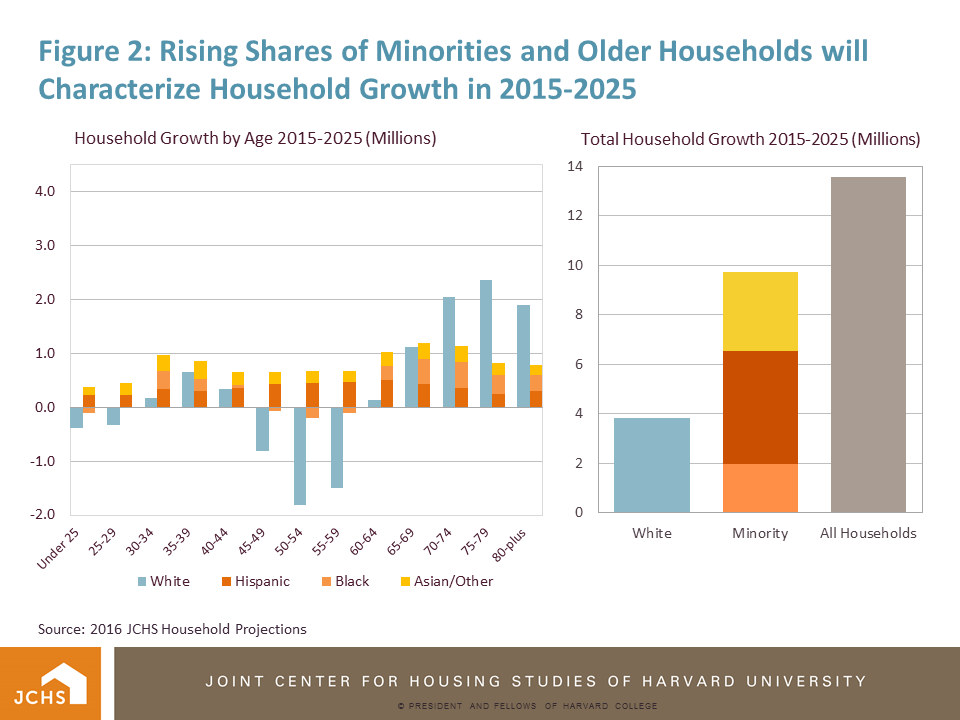

While both changes are significant, the increases from our 2013 household projections are due entirely to the new Census Bureau population projections. In contrast, the methodological changes produce slightly lower projected growth than our previous methodology. However, the methodological changes do affect the distribution of household growth by age, race and ethnicity. In particular, they increase household growth among the oldest age groups and also among non-Hispanic whites between 2015 and 2025. In contrast, they reduce growth among 25-44 year olds as well as from black and Hispanic households.

Despite these shifts, millennials and minority households are still projected to be the main drivers of household growth in coming decades. Indeed, millennials under age of 30 in 2015 are projected to form 23 million net new households between 2015 and 2025, while 72 percent of household growth overall is expected to be non-white households. At the same time, aging of the baby boom generation will bring the number of senior households up to unprecedented heights (Figure 2). Together these forces will reshape housing demand over the next two decades.

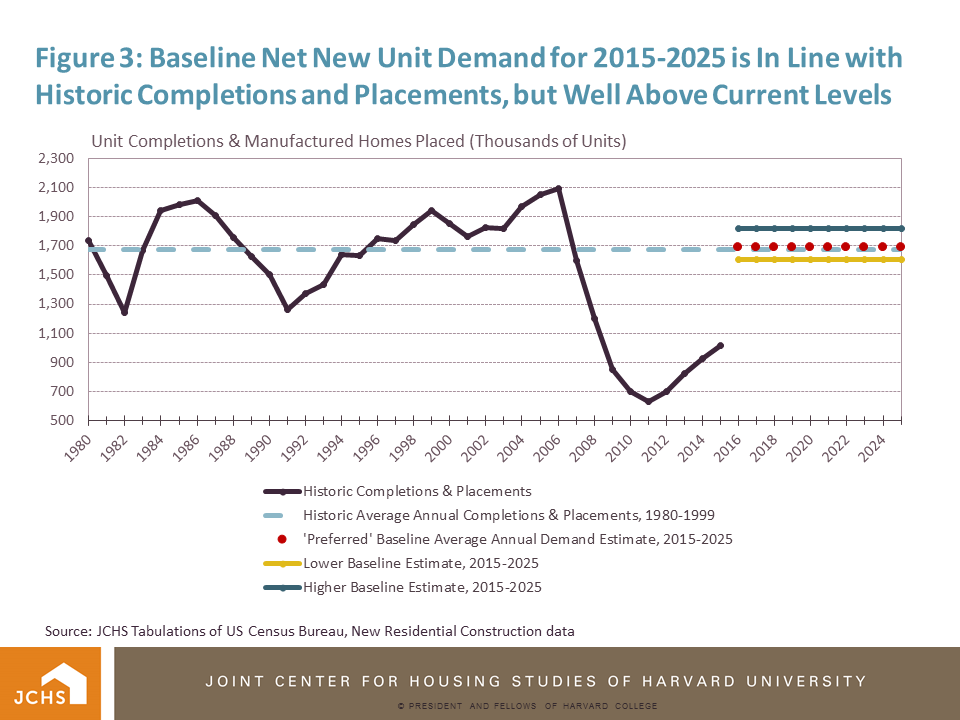

In addition to the estimates on household growth, the working paper includes an addendum with baseline estimates for the amount of new residential construction that might be needed to accommodate future household growth, as well as the demand for replacement units, second homes, and other changes. Combined, these factors suggest that the baseline demand for new housing units between 2015 and 2025 will range from 16.0 to 18.2 million units. While this estimate is well above most recent rates of new unit completions and mobile home placements, it is consistent with historic averages for past 10-year periods (Figure 3). Although the analysis does not factor in estimates of over- or under- supply, the estimates do suggest underlying demand will support higher construction levels and that the growth in residential construction seen over the past five years is likely to continue.

Read the full working paper: Updated Household Projections, 2015-2035: Methodology and Results,