Older Adults with Moderate Income Cannot Afford the Dual Burden of Housing and Care

In the US, millions of older adults struggle to afford both housing and the long-term care (LTC) services they increasingly require as they age, such as help with personal care, housekeeping, and shopping. In fact, as detailed in our recent Housing America’s Older Adults report, only 14 percent of adults age 75 and older who live alone can afford a daily home health aide visit after paying for housing and other living costs, and just 13 percent can afford an assisted living facility in their area.

To better understand the dual burden of housing and care costs faced by a growing numbers of older adults, we studied 97 metropolitan areas and found that the share who could afford both housing and daily assistance varied significantly by metro. For example, more than 20 percent of adults age 75 and older who live alone can afford the combination of housing and care in Sarasota, FL, Jackson, MS, and Madison, WI. But fewer than seven percent can afford these total costs in Springfield, MA, Dayton, OH, and Portland, ME.

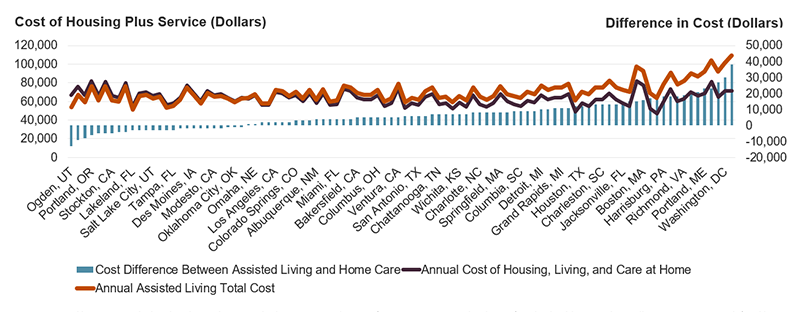

Some of this variation is due to the relative costs of care which differ by metro. In most places, the combined costs of housing, other typical expenses, and a daily four-hour block of in-home care (a standard minimum) is more affordable than the base rate charged for assisted living plus out-of-pocket medical costs and other expenses (Figure 1). Cost differences were especially striking in Bridgeport, CT, where four hours of daily in-home assistance cost $38,000 per year less than assisted living. In other metros, however, older adults who needed daily support could save nearly $13,000 per year by moving to an assisted living facility. This interactive map provides a per-metro comparison of the costs for the two options.

Importantly, LTC and assisted living are not interchangeable. The former is best suited to individuals who can afford their housing and have care needs that can be adequately addressed with a few consecutive hours of assistance, while assisted living can meet more substantial or intermittent needs.

Figure 1. Daily Care at Home is Often More Affordable than Assisted Living

Of course, some older adults may be eligible for federal rental assistance, particularly for the 58 percent with annual incomes under 50 percent of their area median income (AMI). Similarly, many states offer home and community-based services through Medicaid waiver programs. However, program design and eligibility criteria vary by state, which can curtail access. Further, neither housing assistance nor publicly funded LTC services are entitlements and only about a third of eligible households receive the crucial support. Waiting lists can extend for years.

Additionally, millions of older adults are both unable to afford assisted living and also ineligible for housing support. Because they fall into the gap between affordability and public assistance, we call these “GAPS households,” and estimate the population to be 29 percent of adults age 75 and older who live alone. Almost two-thirds of GAPS households have annual incomes ranging from 67 to 200 percent of AMI, qualifying them as “middle class." The remainder have incomes between 50 and 67 percent of AMI.

Just 8 percent of GAPS households are able to afford the minimum four-hour daily home visit, making this option untenable for most. Further, on average, GAPS households have less than two thirds of the income necessary to afford the area median assisted living cost, and as little as half in some metros (Figure 2). However, the upper end of the GAPS group was much closer to affordability. In fact, over 6 percent of GAPS households were within $5,000 annually of affording the rates of their local median priced assisted living facility plus additional personal expenses such as healthcare and clothing.

Figure 2. GAPS Households Have Incomes between 49 and 85 Percent of What is Needed to Afford Assisted Living

| Metro | Median Income of Single-Person Households Age 75 and Over (Dollars) | Annual Median Cost of Assisted Living and Other Costs of Living (Dollars) | Ratio of Income to Cost of Assisted Living | |

|---|---|---|---|---|

| Highest Ratios | Ogden, UT | 45,800 | 54,000 | 85 |

| Salt Lake City, UT | 51,800 | 63,100 | 82 | |

| Los Angeles, CA | 55,000 | 72,000 | 76 | |

| San Diego, CA | 50,400 | 66,800 | 75 | |

| San Francisco, CA | 70,000 | 96,800 | 72 | |

| Lowest Ratios | Modesto, CA | 33,000 | 64,700 | 51 |

| Grand Rapids, MI | 38,500 | 75,400 | 51 | |

| Toledo, OH | 33,880 | 67,600 | 50 | |

| Harrisburg, PA | 38,400 | 78,500 | 49 | |

| Greensboro, NC | 33,500 | 69,200 | 49 | |

| Total | 44,400 | 72,000 | 62 | |

As a ratio of cost of living and care to income, affordability varied by geography. In markets that offered a wider range of assisted living options and costs, more households could afford the facilities. Notably, some markets had a handful of very low-priced units, which dropped yearly prices over $40,000 under median in Bridgeport, CT, San Jose, CA, and Richmond, VA. While these units may offer fewer services and amenities, they were able to serve households with lower incomes; 44 percent of GAPS households that couldn’t afford the median priced unit were able afford the lowest priced unit in their metro. This suggests that a concentration on these discounted units might expand access for GAPS households who require assisted living.

Regional variation in assisted living affordability suggests that some older adults might move to lower cost markets where their income would stretch farther. However, in reality, few choose this option. A scant 1 percent of older adults moved to another state between 2016 and 2021, and the proximity of family is often a strong consideration.

Home equity also creates opportunities for many GAPs households to pay for care, either at home or in assisted living. More than three quarters of these households owned their home as of 2021, with a median home equity of $250,000. Upon sale, the proceeds could fund care in assisted living for a period of time. However, this may not be a viable option for the 28 percent of GAPS homeowners with outstanding mortgage debt, which reduces their available equity and makes further leveraging more difficult.

Older households need more and better options to successfully manage the dual burden of housing and care. These could include more robust housing subsidies for those with the lowest incomes, expanded home and community based services under Medicaid, aligning eligibility for housing and health subsidies with other entitlement programs, offering more individualized, unbundled LTC service options, and promoting efficiencies that bring down service costs. As the US population continues to age, the need for both services and support that older adults can afford will only increase.