More Existing Homes Will Have Smart Home Tech

Smart home technology—widely understood as devices that enable remote control and/or monitoring of household systems—is expected to be a major area of growth for the remodeling industry over the coming years. Our Remodeling Futures Program recently conducted a literature review of major studies on this topic and identified seven key takeaways, as well as areas where further study is needed. Here’s what we know:

- Many consumers are excited about installing smart home tech. A 2015 Demand Institute survey found that nearly half of homeowners who were likely to undertake home improvements in the next three years were excited about incorporating smart home technology into their projects. Moreover, 30 percent reported being somewhat or very likely to install home automation products or features. Owners with high incomes and home values, and those under 45, were more likely to place importance on having these features. A similar study by Houzz in 2016 identified a slightly higher share of renovating homeowners, or 45 percent, as installing or planning to install one or more smart home devices.

- After renovations, those homeowners who installed smart home tech are more satisfied. The same Houzz survey of homeowners who completed renovations in 2016 found that those who added smart home devices across several categories—security/safety, entertainment, climate control, and lighting—were more satisfied than those who opted for a non-smart upgrade.

- While households rely extensively on professionals to install smart home tech, demand is increasing for do-it-yourself (DIY) devices. Houzz also found that when their projects included smart home features, households were more likely to work with a professional installer, particularly when it came to certain safety upgrades such as alarms/detectors, motion-sensing lighting, and cameras. But demand for DIY devices is increasing, particularly among young households. According to a GfK survey, 52 percent of consumers wanted to install their own smart home products in 2018, up from 43 percent in 2015. Manufacturers that can provide easy-to-install DIY products should have an advantage in the future.

- Devices that can be controlled centrally from a smartphone or computer are in high demand. The same GfK study also found that 62 percent of consumers want their smart home devices to be able to communicate with each other. Indeed, products that can be wirelessly integrated into a seamless, centralized system are poised for more growth in the future. The exception may be products marketed toward older homeowners who are still not as tech-savvy.

- Despite lingering security concerns, households appear willing to pay more for smart home tech. More than half of consumers find IoT (Internet of Things) devices “creepy”, and three-quarters distrust the way data is shared, according to a global survey by the Internet Society. At the same time, however, only 28 percent of consumers in the countries surveyed (US, Canada, France, Australia, UK, and Japan) would forgo purchasing smart devices due to security concerns. Indeed, a John Burns Real Estate Consulting survey of new home shoppers in the US found that in 2017, 80 percent opted to include smart home upgrades. Upgrades that home shoppers were most willing to pay more for included smart thermostats and smart security, with the latter especially in-demand among older households.

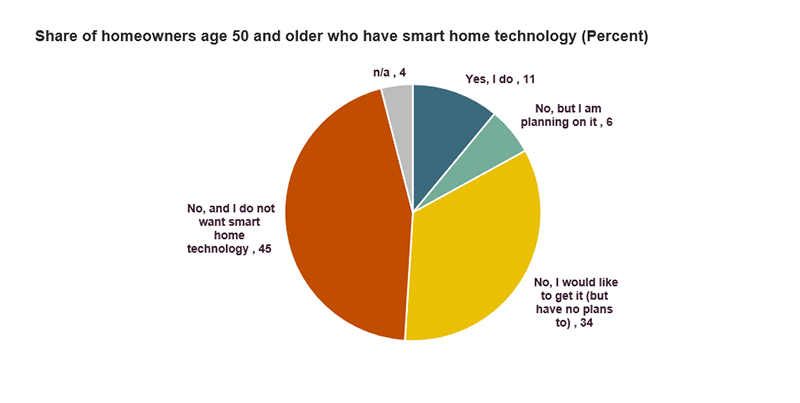

- Smart home tech can assist aging in place, and half of older homeowners want or already have it. A study by The Hartford and the MIT AgeLab found that 51 percent of homeowners age 50 and older already had smart home technology or were interested in getting it (Figure 1). They found that the top three benefits of smart home technology were enhancing safety/security, saving energy, and making daily life easier/more convenient. They also identified the “top 10 smart home technologies” for older adults, including smart alarms/detectors, lighting, water shutoff valves, security systems, outlets, thermostats, and windows/blinds, in addition to wireless doorbell cameras, keyless entry, and water and/or mold monitoring sensors. The potential benefits of connected devices are also clear for households with specific health conditions, for whom emerging technologies such as smart beds and smart fall detection systems can make aging in place, even while living alone, a safer and more viable option.

Figure 1: While Few Older Homeowners Have Smart Home Technology, Many Want It

Source: JCHS tabulations of The Hartford and the MIT AgeLab, “Top Smart Home Technologies for Mature Homeowners.”

- Finally, more remodelers are already engaged in installing these products, and many are seeing increased revenues as a result. Back in 2016, the Joint Center for Housing Studies and the Farnsworth Group surveyed remodeling contractors and found that 28 percent reported increasing revenues from projects involving home automation. For comparison, this was only somewhat below the shares reporting increased revenues from energy efficiency (34 percent) and aging in place (42 percent). Over half of contractors were installing home automation features regularly and, given the natural overlap between aging in place and home automation projects, smart home remodeling seems poised for additional growth in the years ahead.

In short, we know a lot about the rapidly growing smart home tech industry but there are holes in our knowledge, particularly with regard to how this technology is actually integrated into remodeling projects. For example, we don’t know how smart home tech is commonly being integrated into remodeling jobs: Are general contractors offering these upgrades to clients, or do the upgrades primarily come though their sub-contractors? Or do most of the requests come directly from clients? To what extent are remodelers who specialize in aging in place upgrades aware that smart home tech can aid those efforts, and how often do they offer smart home upgrades? In addition, what is the role of manufacturers in driving installations of smart home tech products in the context of traditional home remodeling projects? A Joint Center for Housing Studies survey of general remodeling contractors is planned for the summer of 2019, which will help answer these and other related questions.