Locked Out: Why Homeownership Is Out of Reach for Many Young Hispanic Families

For many families in the US, owning a home is a cornerstone of stability and economic security. This blog launches a series exploring the systemic barriers Hispanic families face in building, sustaining, and passing on housing wealth, starting with the challenges younger households encounter when trying to buy a home. In our paper, "Cumulative Disadvantage in Hispanic Homeownership: Barriers to Passing Housing Equity to the Next Generation," my co-authors and I examine these barriers across all phases of homeownership.

We frame four stages of the homeownership lifecycle: becoming a homeowner, maintaining homeownership, late-life homeownership, and the transfer of housing wealth to future generations. Hispanic households experience distinct challenges at each stage that, together, contribute to persistent racial and ethnic gaps in homeownership and wealth. We explore the first stage—becoming a homeowner—by examining how income, wealth, credit, and geography shape the early barriers Hispanic households face.

The Homeownership Gap Starts Early

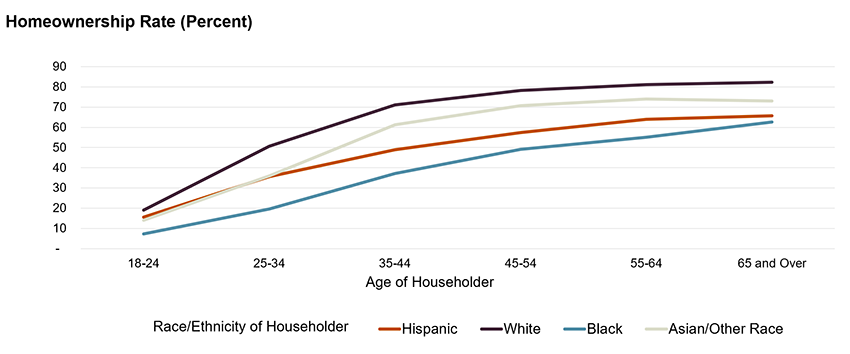

Homeownership rates for first-time buyers typically peak between 35 and 44, making this a critical window to examine persistent disparities. Hispanic households tend to enter homeownership later in life, with a median first-time buyer age of 34, compared to 31 for white households. The delay in Hispanic homeownership reflects a set of early barriers that appear long before families are ready to purchase a home. Indeed, the homeownership rate for Hispanic households between the ages of 35 and 44 was 22 percentage points lower than that of non-Hispanic white households in the same age group (Figure 1).

Figure 1: The Widest Homeownership Gaps Between Hispanic and White Households Are Among Those Aged 35–44

Source: JCHS tabulations of US Census Bureau, 2022 American Community Survey 1-Year Estimates.

A number of factors contribute to this gap, including differences in income and wealth. These factors compound one another, increasing barriers for Hispanic households and making homeownership more difficult to attain.

Renters need sufficient income to save for a downpayment and qualify for a mortgage, yet Hispanic renters have less. Among households aged 35 to 44, Hispanic renters had a median income of $53,020, compared to $63,900 for white renters in 2022. These income disparities are only partially explained by educational attainment; fewer Hispanic residents attain a college degree, but wage gaps persist even with similar levels of education.

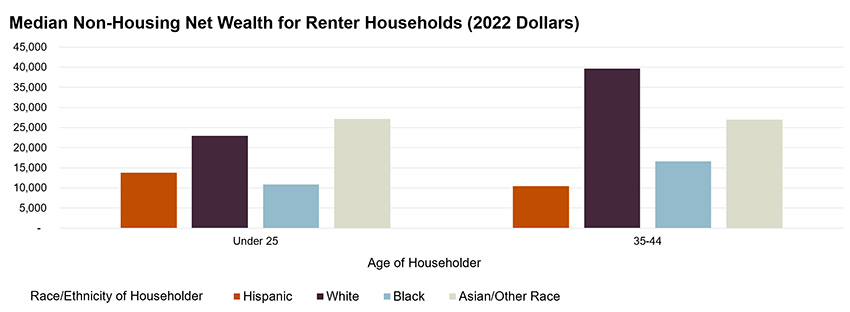

Wealth disparities are even more pronounced. Among renters aged 35–44, Hispanic households had a median net wealth of $10,400—just over a quarter of the $39,670 held by white renters (Figure 2). This limited wealth, especially in liquid assets like savings, makes it difficult to cover up-front homebuying costs such as downpayments and closing fees. With little cash on hand, Hispanic buyers struggle to compete in tight markets that demand fast out-of-pocket payments for inspections, appraisals, and other required expenses. It also places Hispanic renters at a further disadvantage in markets where rising prices, tight supply, and institutional investor activity intensify competition.

Figure 2: Younger Hispanic Renters Have Less Net Wealth than White Renters

Notes: Hispanic householders may be of any race. White, Black, and Asian/Other Race householders are non-Hispanic.

Source: JCHS tabulations of Federal Reserve Board, 2022 Survey of Consumer Finances.

Limited Family Financial Transfers and Credit Constraints

Family financial support often helps first-time buyers with up-front homebuying costs, especially those buyers with lower incomes and limited savings. Yet Hispanic households are far less likely to receive such assistance. In fact, only 7.2 percent of Hispanic households reported receiving an inheritance or substantial financial gift, compared to 29.9 percent of white households. When Hispanic families do receive inheritances, the median amount ($52,200) is significantly lower than the $88,500 received by white families.

Beyond limited family resources, many Hispanic households face challenges accessing other forms of credit—such as credit cards, auto loans, or personal lines of credit—which are essential for managing housing-related expenses like repairs, maintenance, and emergencies. In 2022, Hispanic households were 1.5 times more likely than white households to be denied credit of any kind in the past five years.

Fear of denial further discourages credit seeking. Seventeen percent of Hispanic households in 2022 said they avoided applying for credit due to concerns about being rejected, compared to just 4 percent of white households. This reluctance may limit access to financial tools that help households manage housing costs and maintain stability.

Debt burdens also restrict access. Among renters aged 35–44, the median debt-to-income ratio for Hispanics was 0.29, nearly double the 0.15 ratio for white renters. This reflects both lower incomes and higher balances on vehicles and credit cards, which may further reduce eligibility for credit.

Where You Live Matters

The varying cost of housing across the country plays a major role in whether families can afford to enter homeownership. In 2022, 61 percent of Hispanic homeowners lived in the most expensive US housing markets, compared to just 39 percent of white homeowners. High costs make it harder for lower- and middle-income buyers to enter the market, as they must save more for a downpayment and qualify for larger loans.

Looking Ahead

Lower incomes and wealth, limited credit access, and residence in high-cost markets delay homeownership for many Hispanic families, undermining their ability to build and transfer housing wealth across generations. Expanding credit access, affordable ownership programs, and support for first-time buyers are critical steps toward closing this gap.

Our next blog will explore the challenges older Hispanic homeowners face in maintaining homeownership, managing mortgage debt in retirement, and building equity over time.