How Much Assistance Would It Take to Help Renters Affected by COVID-19?

A record 26.2 million people have filed unemployment claims in just five weeks as the economic impact of COVID-19 sweeps the country. With millions of people out of work, households are losing crucial wages. State and federal unemployment insurance benefits will fill much of the immediate gap, but many households could struggle to pay for housing in coming months because many are not covered by unemployment insurance and, for others, the benefits fall short of their needs. As I illustrate below, assistance for renters with at-risk wages could range from $274 million up to a staggering $7.5 billion.

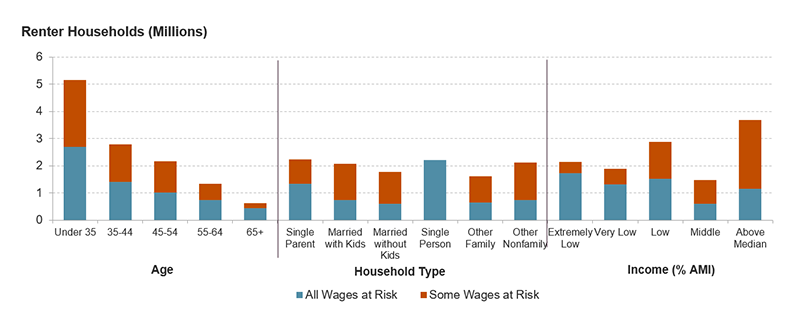

In a previous blog, I noted that at-risk jobs include those in services, retail, recreation, transportation and travel, and oil extraction. In 2018, the most recent year of the American Community Survey, just under 12.1 million out of 43.7 million renter households (more than 1 in 4) had at least one wage earner working in a currently at-risk industry. About 5.7 million of these households had wages from other industries while about 6.3 million only had wages from at-risk industries. Renter households with at-risk wage earners tended to be younger but were nearly equally split across household types (Figure 1). These renters were also spread across income categories, though about a third made more than the local median income.

Figure 1: Renters with At-Risk Wages Are Younger But Otherwise Include a Range of Household Types and Income Levels

Notes: The percent area median income categories are defined as follows: Extremely Low Income – at or below 30% AMI, Very Low Income – 31 to 50% AMI, Low Income – 51 to 80% AMI, Middle Income – 81 to 100% AMI, Above Median Income – more than 100% AMI.

Source: JCHS tabulations of US Census Bureau American Community Survey, 2018.

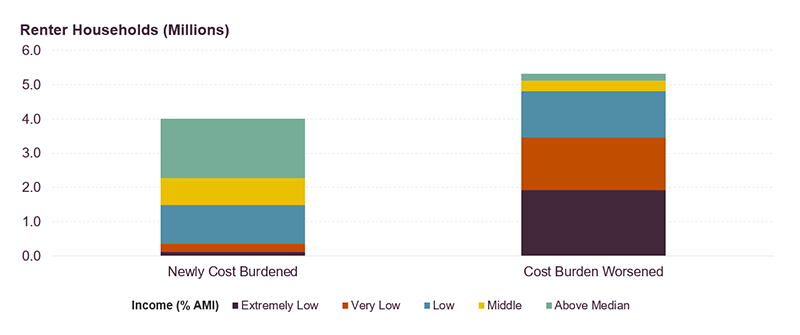

The loss of at-risk wages would increase the number of cost-burdened renters and would add to the number of very low-income households. Already, 5.3 million renter households with at-risk wages were cost burdened before COVID-19 hit, spending more than 30 percent of their incomes on rent and utilities each month. At-risk wages amount to about $33 billion per month, which works out to a potential loss of $2,730 per household. Without these crucial wages, the number of cost-burdened renter households with at-risk wages would rise by 4.0 million to reach 9.3 million. The total number of very low-income (VLI) renter households making up to 50 percent of area median income would also grow by 3.8 million (Figure 2) to 22.2 million.

Figure 2: An Estimated 9.3 Million Renter Households with At-Risk Wages Are Likely to Be Newly or More Severely Cost Burdened

Notes: The percent area median income categories are defined as follows: Extremely Low Income – at or below 30% AMI, Very Low Income – 31 to 50% AMI, Low Income – 51 to 80% AMI, Middle Income – 81 to 100% AMI, Above Median Income – more than 100% AMI.

Source: JCHS tabulations of US Census Bureau American Community Survey, 2018.

Unemployment Insurance Goes a Long Way, But Doesn’t Help Everyone

State and federal unemployment insurance has the potential to make up a great deal of the wages lost. While unemployment weekly maximums and weeks of coverage vary from state to state, the federal CARES Act provides three important mechanisms for additional support. First, it allows states to extend their unemployment insurance periods by 13 weeks. Second, it expands the pool of those who are eligible for unemployment insurance to include contract, self-employed, and gig-economy workers. Third, it creates the Federal Pandemic Unemployment Compensation (FPUC) program that adds $600 per week to anyone receiving state unemployment insurance through July 31.

The federal supplement and state unemployment insurance will go a long way but will not help everyone with lost wages. Some people have had trouble accessing these benefits. Each state has different eligibility requirements, and the systems can be difficult to navigate. It can be especially hard for part-time workers who are not eligible in all states, or for people with patchy employment histories who may have difficulty providing appropriate documentation of their earnings. Non-citizens who are legally working in the US might be less likely to apply for unemployment if they don’t know they are eligible or that applying would not jeopardize their chances of becoming a US citizen. Additionally, the fast rise in unemployment claims has overwhelmed state systems, and the federal supplements are not reaching all eligible claimants yet.

Even if unemployment insurance does reach all eligible claimants, many households would still be in a more precarious financial position if at-risk wages are lost. The July 31 expiration of the federal supplement is also a substantial cliff. Thus, it is likely that more households will struggle to pay the rent and meet their basic needs in the months ahead.

Rental Assistance Could Close the Gaps

Rental housing assistance would be one way to close the gap between lost wages and monthly housing costs for renters in at-risk jobs. But how much assistance might be needed? I created assistance estimates for renter households with at-risk wages under three scenarios in which unemployed earners lose at-risk wages but receive:

- State unemployment insurance and weekly federal supplement (best case, through July 31)

- State unemployment insurance only (after July 31)

- No unemployment insurance (worst case, if state unemployment insurance periods expire before the economy rebounds)

I assumed that households with at least $2,000 in lost wages would be eligible for state benefits and would also get the $600 federal supplement. I also assumed that earners would get half of their at-risk wages in state unemployment insurance (most states had a wage replacement rate under 50 percent at the end of 2019) up to the state’s weekly maximum. These two assumptions put my assistance estimates under scenarios 1 and 2 on the conservative side since the minimum income is higher in some states and part-time workers are not always eligible.

Estimating housing assistance needs requires identifying policy targets for housing affordability level. Ideally, the policy goal would be to get all households to the 30 percent standard, meaning they would pay no more than 30 percent of their incomes on housing costs and would not be cost burdened. However, affordability challenges arising from the pandemic are layered on an existing affordability crisis. The estimates seek to address pandemic-related affordability challenges for households with at-risk wages only. These estimates are anchored to the affordability targets shown in Figure 3 and are determined based on the starting and projected cost burden level for each household. These targets are shallow, representing the absolute minimum that would be needed to get these households approximately back to where they were before the pandemic began.

Figure 3: Affordability Targets for Rental Assistance Estimates

| Starting Cost Burden Status | |||

|---|---|---|---|

| Projected Cost Burden Status | Unburdened | Moderately Burdened | Severely Burdened |

| Unburdened | — | — | — |

| Moderately Burdened | 30% affordability standard |

previous cost-to-income ratio |

— |

| Severely Burdened | 30% affordability standard |

previous cost-to-income ratio |

previous cost-to-income ratio |

To estimate rental housing assistance needs, I calculated a projected income under each scenario by subtracting any at-risk wages from the reported household income and adding relevant unemployment benefits. I then recalculated the cost burden status for each household. Using the policy targets above, I calculated the housing cost based on the affordability target. I subtracted this amount from their current monthly housing costs to identify the housing assistance need for each household. The final estimates shown in Figure 4 are the sum of these needs.

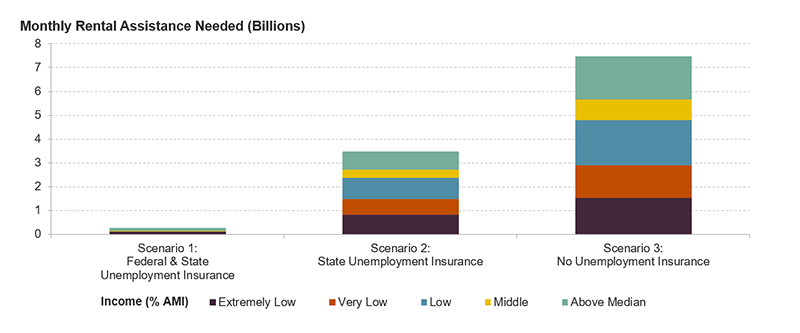

Figure 4: Total Monthly Assistance Needs for Renter Household with At-Risk Wages Range from $274 Million to $7.5 Billion

Notes: The percent area median income categories are defined as follows: Extremely Low Income – at or below 30% AMI, Very Low Income – 31 to 50% AMI, Low Income – 51 to 80% AMI, Middle Income – 81 to 100% AMI, Above Median Income – more than 100% AMI.

Source: JCHS tabulations of US Census Bureau American Community Survey, 2018.

The rental housing assistance need is lowest under scenario 1 at $274 million per month. About 40 percent of that amount would be for households who started out as VLI. The federal benefit is a substantial income to household incomes for those with low wages, and it would actually reduce cost burdens for many of these households. Under this scenario, only about three-quarters of a million households with at-risk wages would need additional rental assistance. However, scenario 1 is only plausible until July 31 when the federal supplement expires.

Without the federal benefit, the monthly housing assistance need rises dramatically to $3.5 billion and 8.1 million households under scenario 2, with VLI households making up 43 percent of that need. The federal 13-week extension of state benefits means state-level unemployment insurance will last for most of the year. Scenario 3 is therefore the least likely but represents the worst case in which state benefits periods end before the economy recovers. Under this scenario, pandemic-related rental assistance needs reaching $7.5 billion per month for 9.3 million households. As noted above, these estimates exclude the cost of addressing existing affordability challenges for VLI renters, which would add at least $7 billion per month to achieve a 30 percent affordability standard.

The CARES Act does provide additional appropriations for existing rental assistance programs. This additional funding is important and necessary for shoring up existing programs. It does not, however, meet the potential new vast need for assistance, especially for households above the VLI threshold who typically do not qualify for rental assistance, nor does it provide enough to stabilize VLI households who already faced housing insecurity. The scope of the coronavirus crisis in the context of an ongoing affordability crisis will require much more.