How HOPE Creates Opportunity in Rural Areas

The papers from the third panel of the Joint Center’s symposium on A Shared Future: Fostering Communities of Inclusion in an Era of Inequalityfocus on policies that might increase access to opportunities in three major metropolitan areas (Chicago, Houston, and Washington, D.C.). But in many rural areas, as well as many non-major metros, the challenge is often less about developing policies to create equitable access to the opportunity that exists than it is about creating opportunity in the first place—and then ensuring more people can afford to access it.

We believe the experiences of HOPE, a family of development organizations dedicated to strengthening communities, building assets, and improving lives in economically distressed parts of Alabama, Arkansas, Louisiana, Mississippi, and Tennessee, show how a capital access strategy can help people in non-major metro and rural markets where, compared to high-growth markets, zoning and land-use policy tend to be less comprehensive, homeownership is more common, and gentrification is less of a concern. Even in rural markets where integration is difficult due to the physical isolation that has developed for many communities of color, homeownership strategies facilitated by access to affordable capital can help households acquire other benefits associated with homeownership, including the possibility that individuals will invest in “places” as way to create communities of opportunity.

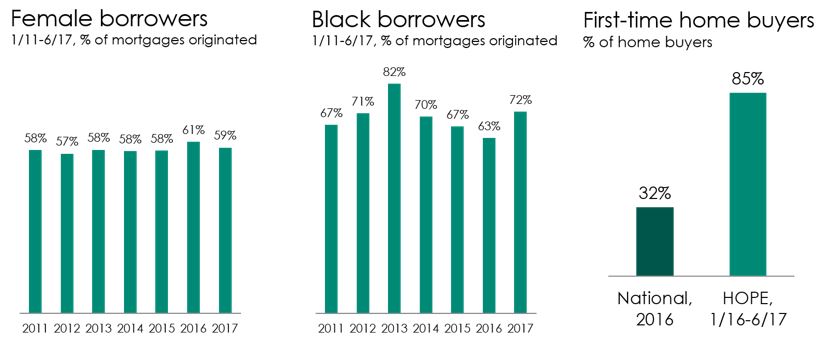

Comprised of a regional credit union (Hope Credit Union), a loan fund (Hope Enterprise Corporation), and a policy center (Hope Policy Institute), HOPE has provided financial services, leveraged private and public resources, and shaped policies that have benefited more than a million residents in one of the nation’s most persistently poor regions. Much of HOPE’s work has focused on increasing access to homeownership, which has long been viewed as a key means of increasing wealth accumulation. In particular, HOPE provides a manually underwritten, high-LTV affordable mortgage product. The product allows HOPE to serve borrowers who have been underserved by conventional lenders such as minorities, women, and/or first-time homeowners (Figure 1).

Figure 1: HOPE Borrower Characteristics

Source: HOPE analysis of HOPE Mortgage Lending Portfolio for January 2011-June 2017; National Association of Realtors®, “First-time Homebuyers: Slightly Up at 32 Percent of Residential Sales in 2016.”

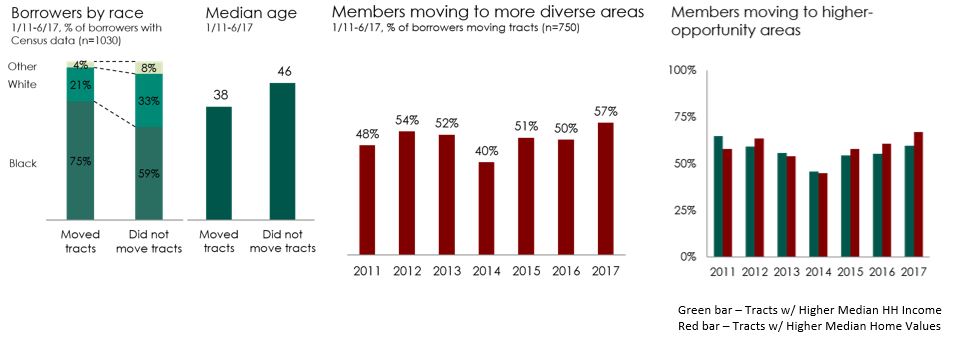

HOPE’s experiences also shed light on efforts to increase access to “opportunity communities” – places with more resources, less crime, better-quality schools, etc. Recent research by Raj Chetty and Nathaniel Hendren suggests that growing up in such places “has significant causal effects” on a child’s “prospects for upward mobility.” In fact, since 2011, more than 50 percent of HOPE’s borrowers bought a house in a census tract other than the one in which they had previously been renting. Moreover, those tracts generally had higher household incomes, higher median home values, higher average educational attainment, and better schools than the tracts the buyers were leaving. Interestingly, while the “movers” tended to be younger and black (compared to borrowers who did not move from their census tract), there were few differences in the incomes or home values between the two groups (Figure 2).

Figure 2: HOPE Borrower and Community Characteristics

Related to Borrower Relocation

Source: HOPE analysis of HOPE Mortgage Lending Portfolio for January 2011-June 2017

Moreover, the focus on moving to opportunity areas should not obscure the significance of the many borrowers who stayed in the same census tract. Research suggests that homeownership is predictive of increased community participation and other positive social outcomes, a finding that is consistent with our experiences among borrowers who did not move to another census tract.

In addition, the large number of people making commitments to their existing communities reminds us that, as Chetty and Hendren note, efforts to increase opportunity should focus both on giving people a chance to move to opportunity and to finding “methods of improving neighborhood environments in areas that currently generate low levels of mobility.” This view is echoed and amplified by Houston Mayor Sylvester Turner who, as noted in Bill Fulton’s paper, has “argued forcefully that children in underserved neighborhoods should not have to move to high-opportunity areas in order to find a path to success in life.”

HOPE’s experience is that investing in people and investing in place are both necessary, and each is insufficient on its own. Moreover, HOPE’s efforts underscore the importance of creating and ensuring access to opportunities in rural and non-major metro areas that currently lack them. Creating these opportunities requires broader access to capital at least as much as it requires thoughtful land-use policies, and it requires meeting people where they are as much as it requires helping them move.