Homeowner Mobility Stalls Amid Rising Interest Rates

Though home prices are high and still rising, high interest rates are discouraging many homeowners from selling and getting a new mortgage on a different home—and homeowner mobility has consequently stalled. Even with recent declines, mortgage interest rates are currently twice what they were in 2021, creating a “lock-in effect” for many mortgaged homeowners who bought or refinanced early in the pandemic when interest rates were at record lows. The combination of high prices and interest rates has also priced many would-be homeowners out of the market. Without a substantial decrease in either prices or rates, there is no clear path for homeowner mobility to significantly recover. In the context of an increasingly less mobile country, this could have broad negative economic effects.

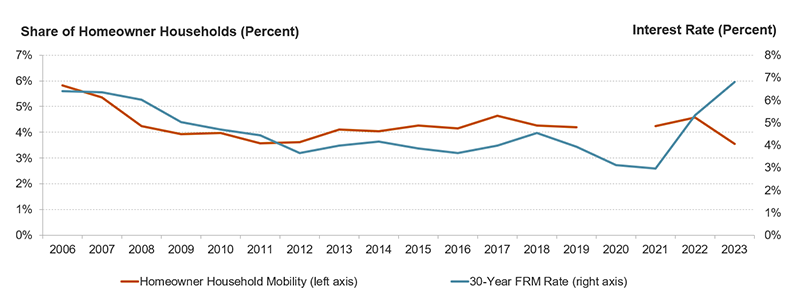

Homeowner household mobility dropped by a full percentage point from 2022 to 2023, according to recently released 2023 CPS-ASEC data. The most recent drop of that magnitude was in 2008, during the Great Recession. That was a time, however, when many homeowners lost equity in their homes or even went underwater on their mortgages, which several studies found negatively affected their mobility. Homeowner mobility recovered over the past decade and continued to increase early in the pandemic—when low interest rates encouraged home purchases—before falling as interest rates soared (Figure 1).

Figure 1: Homeowner Mobility Fell as Interest Rates Spiked

Diminished equity is no longer the issue, however, as home equity is very high nationally – median home equity among homeowners in 2022 was $200,000, according to Survey of Consumer Finances data. Instead, the barrier to mobility is a mismatch between current and recent mortgage interest rates to a degree not seen since the 1980s. Then, mortgage rates spiked from 7–10 percent in the 1970s to a peak of 18.6 percent in October 1981, according to Freddie Mac’s Primary Mortgage Market Survey (PMMS). This created a lock-in effect for many mortgaged homeowners, which had a direct and significantly negative impact on homeowner mobility, according to a seminal study by John Quigley.

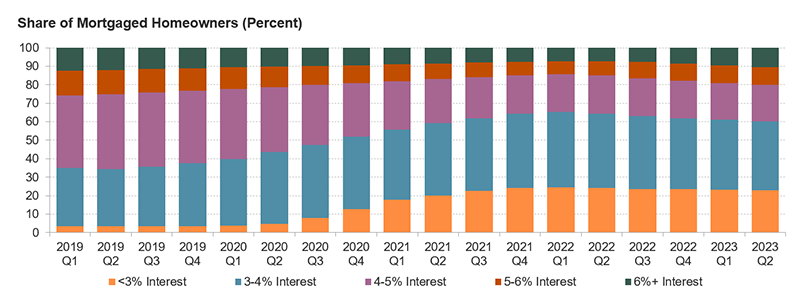

Today’s prevailing mortgage rate is much lower than the peak in the 1980s but remains quite high relative to the record-low rates early in the pandemic. The prevailing 30-year mortgage rate was 7.22 percent as of Freddie Mac’s most recent PMMS in late November 2023, more than double the 3.1 percent rate in late November 2021. Indeed, interest rates stayed below 3.5 percent from mid-2020 through the end of 2021, during which time many homeowners purchased or refinanced. As a result, the average mortgaged homeowner had an interest rate of 4.0 percent in Q2 2023, according to the National Mortgage Database. Fully 60 percent of mortgaged homeowners had interest rates below 4 percent, and nearly all (90 percent) had interest rates below 6 percent (Figure 2). This represents about 29.6 million and 44.4 million homeowner households, respectively, according to 2022 ACS data, out of a total of 84.7 million homeowner households.

Figure 2: Low-interest Mortgages Became Very Common During the Pandemic

Researchers at Freddie Mac calculated an estimate of the lock-in effect for every borrower in July when the prevailing rate was 6.81 percent. Their findings indicated that the average homeowner with a mortgage would need any move to have a net financial gain (e.g. from a higher-paying job or lower cost of living) of at least $55,000 to justify switching to prevailing market interest rates. This lock-in effect varies widely by year of loan origination, with loans originating in 2021 having the highest average lock-in effect of $85,000, which far exceeds historical estimates of the lock-in effect during the 1980s. Freddie Mac’s researchers state that this is already having substantial effects on the housing market, including by exacerbating the lack of for-sale inventory.

Given the current scale of the lock-in effect and the established negative relationship between this effect and homeowner residential mobility, further declines in mobility should be expected in the short term. This could have several broad economic effects. For one, lower mobility could result in inefficiencies in the labor market as households are less likely to relocate to more productive areas or areas in need of workers. The lock-in effect represents an additional moving cost, and research has shown that moving costs can lead to job misallocation and less job-seeking. This could also affect household utility as people will be less likely to move even as their family size or other needs (e.g. schools, health care) change. This could in turn increase traffic as people turn to commuting instead of moving, as one study theorized.

A reduction in interest rates could alleviate the lock-in effect and help lift homeowner mobility. Indeed, interest rates have recently declined, falling by a full percentage point from October to November 2023, though the prevailing rate (7.22 percent) is still higher than the rate on which Freddie Mac based its lock-in effect estimates. Further decreases would reduce the barrier to moving and give homeowners looking to sell a newfound sense of urgency, according to a recent Redfin survey. Barring that, increased housing supply could alleviate house prices and give households more options when they want to move, possibly outweighing the lock-in effect. In the absence of those changes, mobility is likely to stay low for homeowners as the lock-in effect, the housing shortage, and rising prices incentivize staying put.