High Levels of Mortgage Debt Are Associated with Lower Financial Well-Being Among Older Homeowners

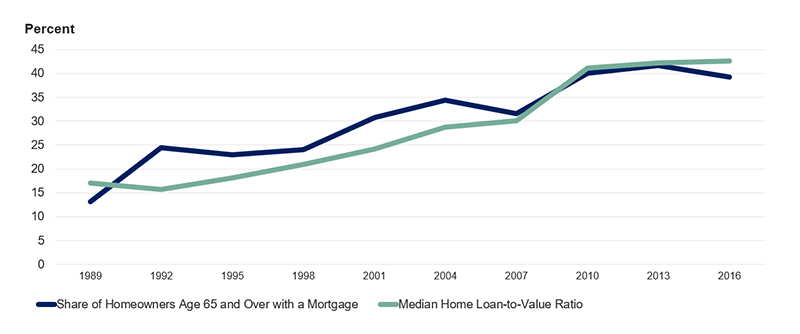

As documented in the Center’s recent report, Housing America’s Older Adults 2019, both the share of older homeowners with mortgage debt and the amount of debt they carry have risen considerably over time. Between 1989 and 2016, the share of older adult homeowners with mortgage debt more than doubled, from 17 percent to 43 percent, while the median loan-to-value ratio on that debt nearly tripled (Figure 1). These trends are worrisome due to their implications for housing affordability. For example, nearly 40 percent of older adult homeowners with a mortgage were housing cost burdened in 2017 (spending more than 30 percent of their income on housing), compared with only 16 percent of those without mortgage debt.

Figure 1: Older Adult Homeowners Are More Likely to Carry Mortgage Debt, and Carry More Debt As a Share of Home Value

Note: The loan-to-value ratio is calculated for homeowners age 65 and over with mortgage debt, including home equity loans and HELOCs secured by primary residence.

Source: JCHS tabulations of Federal Reserve Board, Surveys of Consumer Finance.

Still, the rise in mortgage debt among older homeowners could represent a well-reasoned choice to avoid paying down these loans in order to save more in other financial vehicles or have more disposable income for other needs. However, in a newly released working paper I co-authored with Christopher Herbert and Jennifer Molinsky, we find that holding high levels of mortgage debt is associated with lower levels of financial well-being and a greater likelihood of being financially insecure among older adult homeowners.

According to the Consumer Financial Protection Bureau (CFPB), which supported our research, financial well-being is the “state of being wherein a person can fully meet current and ongoing financial obligations, can feel secure in their financial future, and is able to make choices that allow them to enjoy life.” Financial well-being is not only about objective measures of one’s financial situation, but also subjective criteria like the ability to enjoy life and meet ongoing and future financial goals.

In order to better measure the concept, the CFPB created a standardized measure of financial well-being based on a 10-item questionnaire. Answers to these questions are converted to a validated, reproducible score that ranges from 0-to-100, with higher scores indicating greater financial well-being. After creating the test, the CFPB then commissioned the National Financial Well-Being Survey in 2016 in order to better understand the personal circumstances and financial behaviors that influence well-being.

Our paper uses this survey and finds that housing is an important driver of the financial well-being of older adult homeowners. Indeed, older adult homeowners with at least $50,000 in mortgage debt averaged 59 points on the test of well-being, about 5 points lower than homeowners with lower debt levels (including those without mortgage debt). Differences in financial well-being remained, even after accounting for the different financial circumstances and demographic characteristics of the two groups. In regression models that account for the household income, savings, home value, location, educational attainment, race, sex, and other characteristics of the respondent, homeowners with high debt levels still scored about 5 points less on the test of well-being compared to those with low debt.

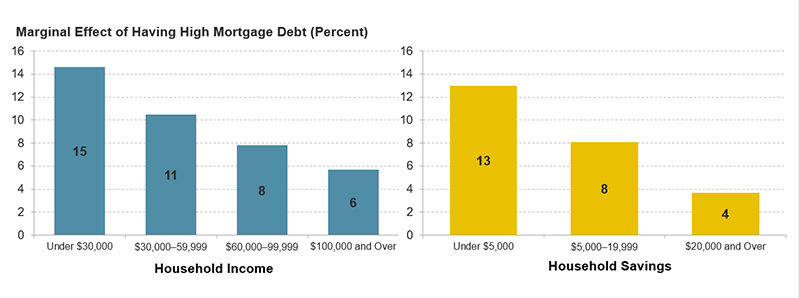

Though this difference might appear small at first glance, having high levels of mortgage debt results in a substantial increase in the likelihood that older adult homeowners are financially insecure (defined as those with financial well-being scores of 50 or under in our study, or respondents who are especially likely to have difficulty covering their monthly expenses). For the otherwise average homeowner, having high levels of mortgage debt nearly doubles the chance of being financially insecure, raising the odds by 8 percentage points to 17 percent. Moreover, older adults with tenuous financial circumstances are more likely to be pushed over the edge. Having high levels of mortgage debt increases the odds of being financially insecure by 15 percentage points for those with annual incomes under $30,000 and 13 percentage points for those with savings under $15,000 (Figure 2).

Figure 2: The Effect of Having High Levels of Mortgage Debt on the Likelihood of Financial Insecurity Varies with Circumstances

Notes: Figure 2 is derived from Table 9 in “The Association Between High Mortgage Debt and Financial Well-Being in Old Age: Implications for the Financial Education Field.” The sample is for homeowners age 62 and over. The omitted group for the primary independent variable of interest is homeowners with under $50,000 in mortgage debt. Marginal effects can be interpreted as the percentage point change in the likelihood of being financially insecure resulting from having more than $50,000 in mortgage debt (relative to having less debt), holding all other variables constant at the mean

Source: JCHS tabulations of Consumer Financial Protection Bureau, 2016 National Financial Well-Being Survey.

Lastly, our research indicates that both financial skill—how one finds, processes, and uses financial information—and habitual saving are associated with a lower likelihood of carrying high levels of mortgage debt. This finding suggests that financial education geared towards encouraging savings and improving financial skill, both before and during older adulthood, are possible remedies to mitigate the increase in high levels of mortgage debt for this population.