High-Income Black Homeowners Receive Higher Interest Rates than Low-Income White Homeowners

Black homeowners not only have primary mortgages with higher interest rates than white homeowners with similar incomes, they also have higher interest rates than white homeowners with substantially lower incomes, according to my new analysis of data from the 2019 American Housing Survey (AHS). While refinancing can lead to lower interest rates and cost savings, even when Black homeowners refinance their mortgages, interest rate disparities exist. These inequities are, in part, due to both historic and recent instances of discrimination in mortgage markets and could be costing black homeowners significant amounts of money.

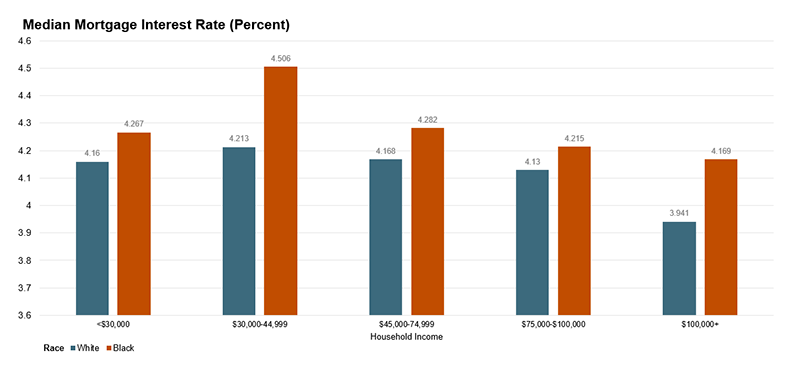

The 2019 AHS data show that while interest rates for primary homes generally decline as incomes increase, when accounting for race, interest rate disparities exist. Black homeowners with incomes between $75,000-$100,000 had higher interest rates than white homeowners with $30,000 or less in household income. Across most income categories, white homeowners with primary mortgages had lower interest rates than the highest-earning Black homeowners with primary mortgages. For example, the median interest rate for Black homeowners who made $75,000-$100,000 was 4.215 percent, while the median interest rate for white homeowners with household incomes of $30,000 or less was 4.16 percent. Even at the highest levels of income (at or above $100,000), Black median interest rates (4.169 percent) were still slightly higher than the median interest rates of white homeowners (4.16 percent) with incomes of $30,000 or less. Interest rates for white homeowners with incomes of $100,000 or more was 3.946, 22 basis points lower than Black homeowners of the same income.

Figure 1: High-Income Black Homeowners Have Higher Interest Rates than Low-Income White Homeowners

Note: White and Black households are non-Hispanic.

Source: JCHS tabulations of U.S. Census Bureau data, 2019 American Housing Survey.

The largest difference in interest rates by income and race, however, were between homeowners with incomes from $30,000-$45,000 (Figure 1). Interest rates for Black homeowners in this category were the highest among all categories at 4.506 percent, while interest rates for white homeowners in the same income category was 4.213, a 29-basis point difference. Twenty-nine basis points can result in significant mortgage cost differences: an interest rate drop from 4.506 percent to 4.213 percent for a home at the US median home price in Q3 2020 of $324,900, with a 30-year fixed-rate FHA mortgage, a 3 percent downpayment ($9,747), and a $1,590 monthly payment results in $12,470 less in interest payments over the mortgage duration.

While many other factors affect interest rates including wealth, debt, credit score, downpayment, mortgage amount, and duration, Black homeowners have experienced systemic barriers to homeownership and wealth-building opportunities that have limited their ability to access credit, which is a key component in receiving low mortgage interest rates. Through redlining policies from 1933 to 1968, US banks denied Black Americans access to financial services and isolated Black populations in areas that would suffer lower levels of investment compared to their white counterparts. More recently, since the 2008 financial crisis, major banks and mortgage lenders have paid multi-million dollar settlements for mortgage discrimination claims, including that they charged Black and Hispanic homeowners higher interest rates than white homeowners with similar credit profiles. These realities of discrimination in mortgage markets have been major factors impeding Black households’ access to homeownership and favorable mortgage terms that help build wealth.

While refinancing a mortgage can lead to lower interest rates, barriers to refinancing also exist including loan-to-value (LTV) ratios, credit constraints, and closing costs. When a borrower applies to refinance their mortgage, the lender will reappraise the value of the home, which can lead to discriminatory outcomes and calculate the current LTV ratio. According to a 2017 Philadelphia Federal Reserve paper, homeowners with high LTV ratios can often be denied refinancing. Also, a lower credit score may reduce the likelihood that a lender will approve a refinance application, particularly since lenders have tightened credit standards in recent years. Additionally, refinancing closing costs are often 2-5 percent of the mortgage loan, averaging $5,749 in 2019, a substantial amount for many homeowners.

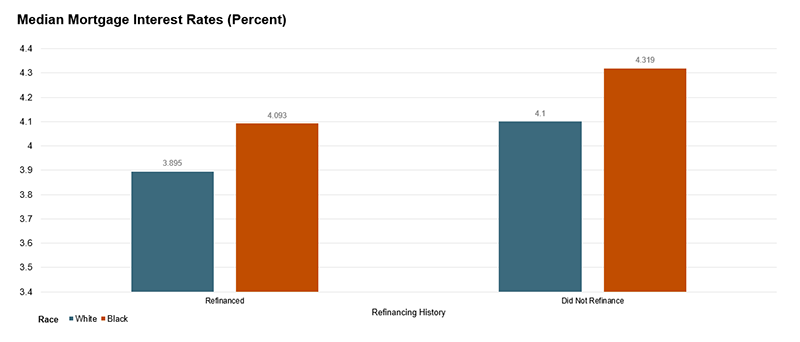

Figure 2: Black Homeowners Who Refinance Have Similar Interest Rates to White Homeowners Who Don’t Refinance

Note: White and Black households are non-Hispanic. Refinanced households are households that have ever refinanced in the past.

Source: JCHS tabulations of U.S. Census Bureau data, 2019 American Housing Survey.

Despite challenges to refinancing, 29 percent of homeowners with primary mortgages have previously refinanced their homes. However, a smaller share of Black homeowners have refinanced their primary mortgages: 31 percent of white homeowners have previously refinanced, while only 20 percent of Black homeowners have. Black homeowners who refinanced their primary mortgages reduced their median interest rates by 22 basis points, from 4.319 percent to 4.093 percent (Figure 2). However, when Black homeowners refinanced, they still had interest rates that were 20 basis points higher than white homeowners who refinanced, and rates that were similar to white homeowners who did not refinance (4.1 percent).

While additional studies are needed to identify the specific causes of Black-white interest rate disparities, widespread racial discrimination in mortgage markets has played a role. Though these findings predate the pandemic, they are particularly striking given that many new and existing homeowners have sought to take advantage of low interest rates during the pandemic to purchase homes or refinance their mortgage. This, in turn, is yet another reason to address the longstanding and continued history of discrimination in mortgage markets.