Emergency Rental Assistance Has Helped Stabilize Struggling Renters

More than one in every ten renter households across the country has applied for federally funded emergency rental assistance (ERA), according to our analysis of recently released data from the US Census Bureau. During the period between August 2021 and early February 2022, households of color and lower-income households were more likely to apply for assistance. At that time, over one-third of applicants had received assistance, another 38 percent were awaiting a decision, and a quarter had been denied.

Since the start of the pandemic, renter households across the US have been more likely to lose income and fall behind on their housing payments. In response, federal interventions have helped to stabilize households’ balance sheets and prevent widespread displacement. Eviction moratoriums, expanded unemployment benefits, and economic impact payment stimulus checks have all directly or indirectly allowed millions of renter households to remain in their homes. More recently, ERA funds—used to pay back rent and utilities—have become increasingly important for struggling renters as other forms of assistance wane.

New data from the US Census Bureau’s Household Pulse Survey shed additional light on the program. About 13 percent of renter households applied for emergency rental assistance to cover unpaid rent or utility bills between August 2021 and February 2022, including about two-fifths of the 10 percent of renters who reported being behind on their rent at the time of the survey. Just under 5 percent of those who pay rent had received emergency rental assistance. Among those who applied, over one-third of applicants (37 percent) reported receiving assistance, with the share reporting receipt trending up over time. From August through October of 2021, about 33 percent of renters on average who applied for rental assistance had received it, compared with 41 percent from December 2021 through early February 2022.

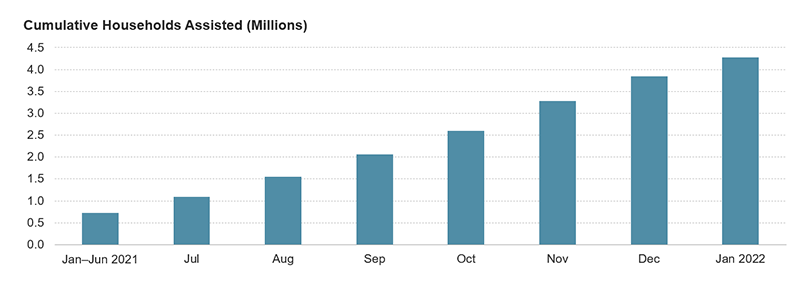

The increase in acceptance rates corresponds with the increased distribution of ERA funds. The disbursement of ERA took several months to get off the ground in 2021, as most state and local governments in charge of administration had to create new programs from scratch. Among other challenges, these programs suffered from a lack of awareness by tenants and landlords alike. As a result, through the first half of the year just 722,000 ERA payments were made to renters according to US Treasury data, but by October that number had nearly quadrupled to 2.6 million (Figure 1). The higher pace of funding was maintained through early 2022 and as of January, 4.3 million payments were made.

Figure 1: Emergency Rental Assistance Was Initially Slow to Reach Renters in Need

Notes: Data include households served by Emergency Rental Assistance. Some households may have received multiple payments and may be double-counted.

Source: JCHS tabulations of US Department of the Treasury data.

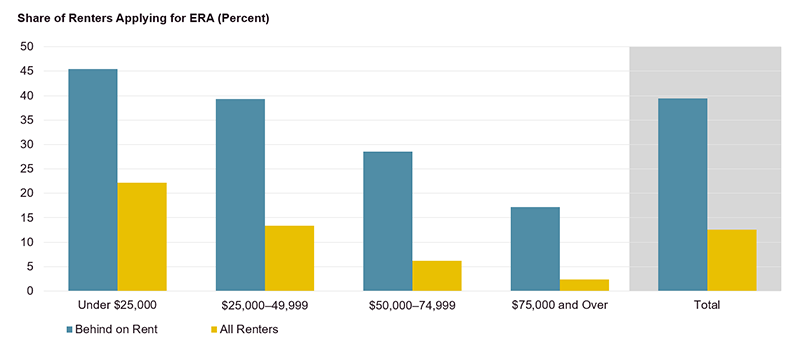

Renter households qualify for ERA funds if they can attest to pandemic-induced financial hardships and have incomes below 80 percent of the area median income (AMI). As a result, lower-income households were both more likely to apply for and to receive emergency rental assistance. In our tabulations of the Household Pulse Survey, 22 percent of renters with incomes below $25,000 applied for emergency rental assistance, compared with just 2 percent of households earning $75,000 or more (Figure 2). These differences also reflect disparities in rent arrears since the beginning of the pandemic. More than one-fifth of lower-income renters were behind on their rent, six times the rate of higher-income renters. But even after falling behind on payments, just under half of lower-income renters (45 percent) had applied for assistance.

Figure 2: Over One-Fifth of Lower-Income Renters Applied for Rental Assistance, Including Nearly Half Behind on Their Rent

Note: Households behind on rent were not caught up at the time of survey.

Source: JCHS tabulations of US Census Bureau, Household Pulse Surveys, August 2021–February 2022.

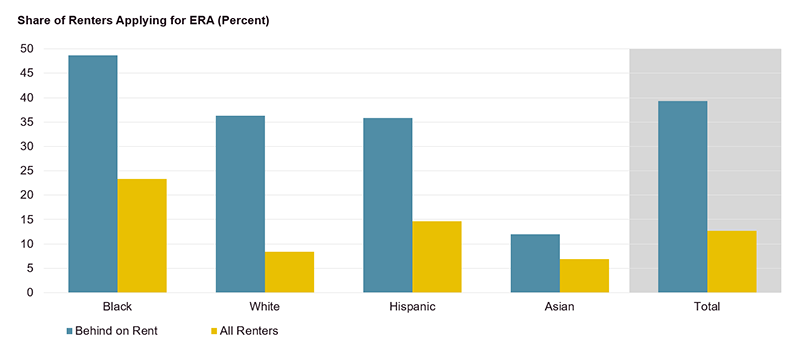

Households of color were also more likely to apply for assistance. According to the Pulse Survey data, about a quarter of Black and 15 percent of Hispanic renter households applied for rental assistance, compared with 8 percent of white and 7 percent of Asian renters (Figure 3). These differences also likely reflect disparities in rent arrears by race and ethnicity. Indeed, Black households were more than three times as likely—and Hispanic and Asian households more than twice as likely—to report being behind on their rent payments compared to white households. And households currently behind on their rent were far more likely to apply for emergency assistance across the board, including nearly half of Black renters, 36 percent of white and Hispanic renters, and 12 percent of Asian renters.

Figure 3: Households Behind on Their Rent Were More Likely to Apply for Rental Assistance Regardless of Race or Ethnicity

Notes: Households behind on rent were not caught up at the time of survey. Black, white, and Asian households are non-Hispanic. Hispanic households may be of any race.

Source: JCHS tabulations of US Census Bureau, Household Pulse Surveys, August 2021–February 2022.

Stemming from these disparities, ERA funds have reached households who need it most. According to Treasury data, about two-thirds of households who received assistance in 2021 were extremely low-income, meaning they had a household income below 30 percent of AMI. Additionally, among those with collected demographic data, 48 percent of ERA recipients were Black, 39 percent were white, 2 percent were Asian, and 2 percent were American Indian or Native American but of any ethnicity. Fully 21 percent of recipients were Hispanic but of any race.

Despite this, over half of low-income renters behind on rent have not applied for rental assistance. Indeed, barriers to accessing ERA program funds persist. Continued lack of awareness, lack of in-home internet access, concerns about eligibility, onerous documentation requirements, and landlord willingness and awareness have all prevented ERA from reaching more eligible households, according to a recent analysis by the National Low Income Housing Coalition. Some renters might also be behind by a small amount or receive some other acceptable accommodation from their landlord. But with an additional $24 billion in ERA funding left to spend, it remains crucial to identify and eliminate the barriers that prevent households from applying in the first place.