COVID-19 Rent Shortfalls in Small Buildings

Renters living in single-family homes and smaller multifamily buildings, along with the owners of those properties, are more likely to be negatively affected by the COVID-19 economic downturn. Over half of renters with at-risk wages due to the pandemic live in single-family and small multifamily rentals with 2–4 units. We estimate that nearly 20 percent of renters in small multifamily apartments may have difficulty paying full rent if at-risk wages are lost, compared to 12 percent of renters living in larger apartments. This could, in turn, make it difficult for the owners of those properties, who are more likely to be small, individual investors, stay afloat through the pandemic.

To date, there is little data on how small landlords are faring and whether their tenants have been able to continue paying rent. The National Multifamily Housing Coalition has been tracking multifamily rent payments on a weekly basis, finding that 87.7 percent of rent payments were made for May as of the 13th, down just two percentage points from the same day the year prior. However, the tracker is skewed toward buildings with at least five units. The president of NMHC noted this limitation, stating that “…it’s important to understand that our metric does not capture rent payments for smaller landlords… These excluded properties are the ones more likely to house residents experiencing financial stress.”

The households living in single-family and small multifamily rentals are more vulnerable but have fewer federal protections. Only 12 percent of the units in small rentals (1–4 units) are covered by the CARES Act eviction moratorium, compared to half of renters in apartments with at least 5 units. Tenants in larger multifamily buildings can also check their address through online tools to see if they live in a protected building, but these databases do not include single-family or small multifamily rentals. Households living in small rentals tend to have lower incomes and are more likely to be headed by a person of color, but we don’t yet know the extent of the affordability challenges they will face because of pandemic-related wage loss or what effect that might have on individual investor landlords.

We noted in a previous blog that about 12.1 million renter households (28 percent) have at least one worker in an at-risk industry, including jobs in services, retail, recreation, transportation and travel, and oil extraction. In the current analysis, we compared the tenants and owners of small rentals to those of larger multifamily rentals to understand how single-family and small multifamily rentals might be uniquely affected by COVID-19. We first examined the concentration of at-risk households in these rentals using the 2018 American Community Survey. We also estimated how many households would have a rent shortfall if they lost wages. Finally, we used the 2015 Rental Housing Finance Survey to identify the types of owners who would most be affected if tenants can’t pay their rent.

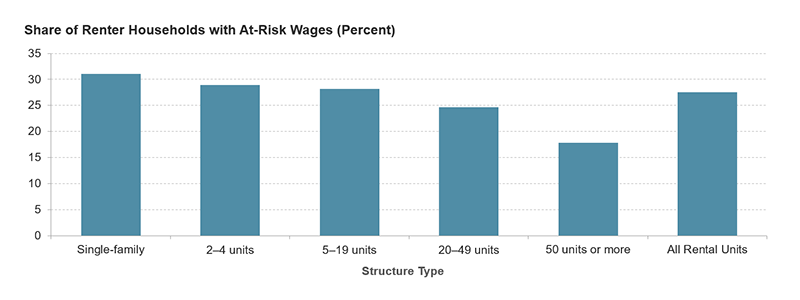

At-risk renters are especially likely to live in single-family and small multifamily rental properties. Households with at-risk wages make up 31 percent of single-family renters and 29 percent of small multifamily renters (Figure 1). Multifamily buildings with 5–19 units have a nearly equal share at 28 percent of tenants with at-risk wages. These shares are all substantially higher than the 18 percent of at-risk renter households in buildings with at least 50 apartments.

Figure 1: Households with At-Risk Wages Are More Common in Single-Family and Small Multifamily Rentals

Notes: At-risk wages include those in services, retail, recreation transportation and travel, and oil extraction.

Source: JCHS tabulations of US Census Bureau, 2018 American Community Survey 1-Year Estimates.

The households in single-family and small multifamily rentals are more vulnerable in other ways as well. Lower median rents for apartments in small multifamily buildings attract lower-income households who have fewer resources to weather an income shock. At the median, household incomes in small multifamily rentals are 11 percent lower than all renter households. These renters are also slightly more likely to be headed by a person of color (51 percent) as compared to tenants in larger multifamily buildings (48 percent). Renters in single-family homes typically have higher incomes but are more likely to be families with children (39 percent), as compared to renters in large multifamily buildings (13 percent), and pay higher rents.

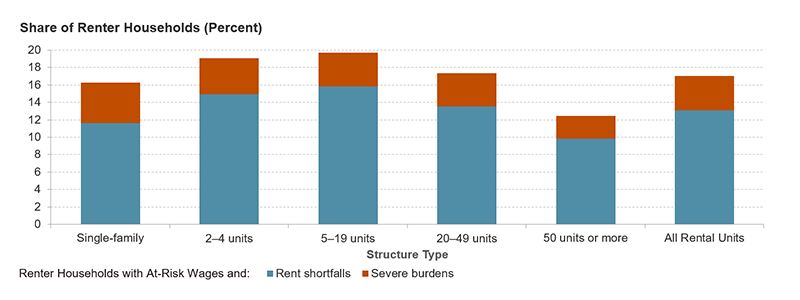

With greater vulnerabilities among tenants, single-family and smaller multifamily rentals may also take a larger hit due to COVID-19 wage losses. While households in single-family rentals are more likely to have at-risk wages, renters in small and mid-sized multifamily units are more likely to face rent shortfalls. We estimated that 12 percent of all single-family renters would not have enough income to pay rent if they lost their at-risk wages (Figure 2). In other words, their income would fall below their monthly rental payment. An additional 5 percent would have to spend more than half of their projected incomes to meet full rent. The shares are even higher, however, for renters living in small and midsized multifamily buildings. About 15 percent of renters in these apartments would have absolute shortfalls from lost wages and about 4 percent would have at-risk wages and be severely burdened by rent payments.

In total, the nonpayment or partial payment rate for small multifamily apartments could be nearly 20 percent, much higher than for large multifamily apartments where the risk is 12 percent. Our estimates for small multifamily track closely with data from the second Census Household Pulse Survey, which indicate that 20 percent of renters who have lost income due to COVID-19 have no confidence that they will be able to pay next month’s rent.

Figure 2: Nearly a Fifth of Households With At-Risk Wages in Small Multifamily Apartments May Have Difficulty Paying Rent

Notes: At-risk wages include those in services, retail, recreation transportation and travel, and oil extraction. Rent shortfalls indicate a household with at-risk wages would not have enough income to cover rent if all wages are lost. Severe burdens indicates that a household with at-risk wages would not have a shortfall but would have to spend more than 50 percent of their projected income on rent if all wages were lost.

Source: JCHS tabulations of US Census Bureau, 2018 American Community Survey 1-Year Estimates.

Missed rent payments would be detrimental for the mom and pop landlords who typically own single-family and small multifamily rental properties and often have their own financial vulnerabilities. According to our tabulations of the 2015 Rental Housing Finance Survey, just over three-quarters of single-family and small multifamily properties were owned by individual investors. Even 40 percent of structures with between 5 and 19 units were owned by individuals, more than double the rate (18 percent) of structures with 50 units or more.

Owners of small rental properties, mom and pop investors especially, might be less equipped to absorb the losses associated with deferred rent payments over a significant period. Almost by definition, the loss of rental receipts for one unit will comprise a larger share of rental income for smaller properties, including 100 percent of rental income in single-family and roughly half of income in two-family properties. Moreover, these property owners have their own ongoing costs. Fully 44 percent of single-family rentals have a mortgage, or some similar debt, with slightly higher shares among individual (45 percent) compared to non-individual (40 percent) owners. An even higher share of properties with 2-to-4 (65 percent) and 5-to-19 units (61 percent) had a mortgage. With higher values, fully 72 percent of properties with 20 or more units also had a mortgage. Across property types, about 96 percent of these mortgaged properties required regular payments, typically on a monthly schedule.

The rental income on single-family and small multifamily rental properties, net of operating expenses, only covers a small share of ongoing debt obligations. Indeed, the debt service coverage ratio is under 80 percent for nearly two-thirds of single-family and small multifamily properties. By comparison, net operating income covers under 80 percent of debt payments in just 37 percent of midsized apartments and 18 percent of structures with 50 or more units. Reductions in rental receipts would mean that many owners of single-family and small multifamily rentals, especially individual owners, would have to dip into their own savings, use high-cost debt, or find some other means to pay their ongoing debt obligations.

Lost income will put renters and small landlords in a vulnerable position. If too many rent payments are missed, there will be ripple effects in the form of unpaid property taxes, deferred maintenance, and mortgage delinquencies. Some small landlords may have to leave the market, opening the possibility of more corporate landlords and loss of rental units to owner-occupancy. The loss of small landlords, who own more than half of the stock renting for less than $750, may also threaten the already dwindling low-rent stock. Whether delivered through tenants or directly to landlords, rental assistance is key to protecting both renter households and small landlords from economic hardship.