Benchmark Update Lifts Remodeling Market Size Projections

By Abbe Will

January 16, 2025

The Center’s Leading Indicator of Remodeling Activity (LIRA) provides a short-term outlook of national home improvement and repair spending to owner-occupied homes and since 2016 has been benchmarked to national spending estimates from the US Department of Housing and Urban Development’s biennial American Housing Survey (AHS). Once every two years, with the release of new historical AHS data, the LIRA benchmark series is also updated. The latest LIRA release incorporates the new benchmark data from the recently released 2023 AHS including revisions to historical spending levels and rates of change for periods formerly modeled by the LIRA. This LIRA release projects national spending for remodeling and repairs to owner-occupied homes will grow to $509 billion in 2025, an increase of 1.2 percent from last year.

Compared with last quarter’s LIRA release, the updated LIRA now shows higher market size estimates and projections for remodeling and repair activity in 2022, 2023, 2024, and 2025. According to Center estimates based on tabulations of the latest AHS, spending growth in 2022 was much more robust than the LIRA model estimated, while in 2023 actual spending declined modestly compared to modest growth estimated by the LIRA model. The difference between estimated and actual rates of change in spending were substantially less in 2023 than in 2022 as seen in Figure 1. Between 2021 and 2022, the homeowner remodeling and repair market expanded 26.6 percent from $407 billion to $515 billion compared with LIRA estimated growth of 15.6 percent. Between 2022 and 2023, the homeowner remodeling and repair market contracted 1.0 percent to $510 billion compared with LIRA estimated growth of 1.9 percent. The much stronger growth in benchmark remodeling and repair spending from 2021 to 2022 has implications for the size of the market previously modeled by the LIRA for 2022, 2023, and 2024, as well as LIRA projections for 2025.

(Click charts to enlarge)

Previously, the LIRA projected a homeowner improvement and repair market size of $473 billion in 2024 with spending growing to $478 billion in 2025. Now with the replacement of AHS-based benchmark data for previously modeled estimates, the LIRA model indicates remodeling activity reached $503 billion in 2024 and projects spending will reach $509 billion this year. The implication of significantly stronger growth in actual remodeling and repair spending from 2021 to 2022 is an expansion in market size estimates for 2024 of 6.4 percent or $30.1 billion, and a similar expansion in market size projections for 2025 of 6.4 percent or $30.5 billion.

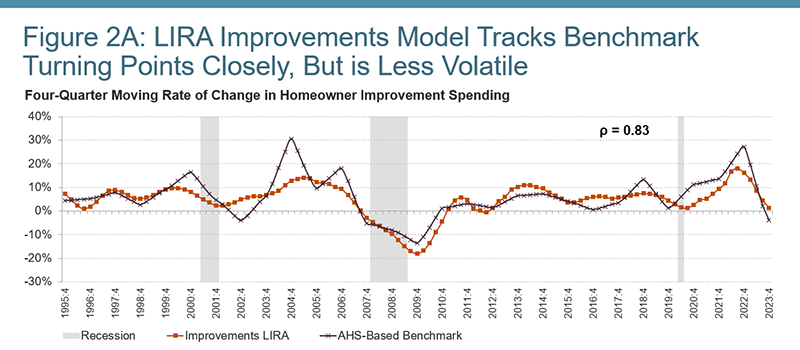

The weighted average of the LIRA model inputs produces the LIRA estimates and projections as seen in Figure 2A (for modeling improvement spending trends) and Figure 2B (for modeling maintenance and repair spending trends) compared with the now-updated AHS-based benchmark data series for 1994–2023. For reference, improvements historically average about 80 percent of total homeowner market spending. Overall, the improvements LIRA tracks the turning points in the reference series very closely, but is less volatile. The estimates produced by the improvements LIRA model and the AHS-based benchmark now have a correlation coefficient of 0.83 (p-value of 0.00), up from the 0.81 correlation coefficient before adding in the updated benchmark data for 2022 and 2023. And a simple regression of the LIRA output on the benchmark spending series results in an R-squared value of 0.6879, which suggests that 69 percent of the variation, or movement, in the improvements spending benchmark can be explained by the LIRA model. These values are also somewhat improved from the last time the benchmark series was updated two years ago.

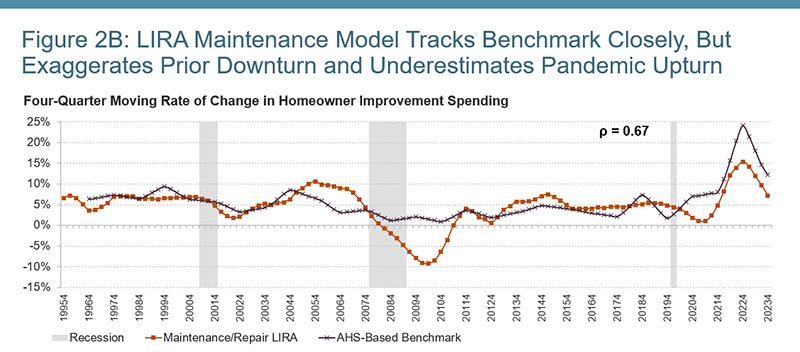

Similarly, Figure 2B compares the weighted average output of the maintenance and repair LIRA model with its AHS-based reference series. The maintenance LIRA has also tracked its benchmark fairly well historically and more so after recovering from the prior remodeling market downturn in 2008. However, the maintenance LIRA significantly underestimated the strength of the pandemic-induced boom in repair spending in 2022 and 2023. The maintenance and repair LIRA and its reference series have a correlation coefficient of 0.67 (p-value of 0.00) and a simple regression of the LIRA output on the benchmark results in an R-squared value of 0.4445, which suggests that about 44 percent of the movement in the home maintenance and repair spending benchmark can be explained by this LIRA model. These values are largely unchanged from the last time the benchmark series was updated in 2023.