Energy Insecurity Threatens to Destabilize Households this Winter

As winter approaches in the United States, many households are preparing for lower temperatures—and now, higher energy prices driven by the increased price of natural gas. These price increases are coming as more than one-quarter of US households were already struggling with energy insecurity, a share that stands to grow given the other challenges to affordability posed by inflation and high housing costs. Fortunately, there are policy tools available that can lighten the load and prevent utility shutoffs for the most vulnerable households.

In the first year of the pandemic, 27 percent of households reported some form of energy insecurity, according to the most recent data from the Residential Energy Consumption Survey (RECS). Energy insecurity was especially high for lower-income households, renters, and householders of color. Fully 52 percent of households that earned less than $20,000 in 2020 experienced energy insecurity that year. Two-fifths of all renter households experienced energy insecurity, compared to one-fifth of all homeowner households. The highest shares of households experiencing energy insecurity by race and ethnicity were among non-Hispanic Black householders (52 percent) and American Indian householders (52 percent), followed by Hispanic householders (47 percent). Energy insecurity rates were lower but still substantial for Asian householders (25 percent) and non-Hispanic white householders (20 percent).

There were notable policy responses to energy insecurity in 2020, including state-level utility shut-off moratoriums. These were widespread early in the pandemic—two-thirds of states instituted a utility shut-off moratorium specifically due to COVID-19 at some point that year. Data suggest that these moratoriums worked to reduce energy insecurity. While 15 percent of households received a disconnect or stop delivery notice in 2015, this share dropped to 10 percent of households in 2020, according to RECS data.

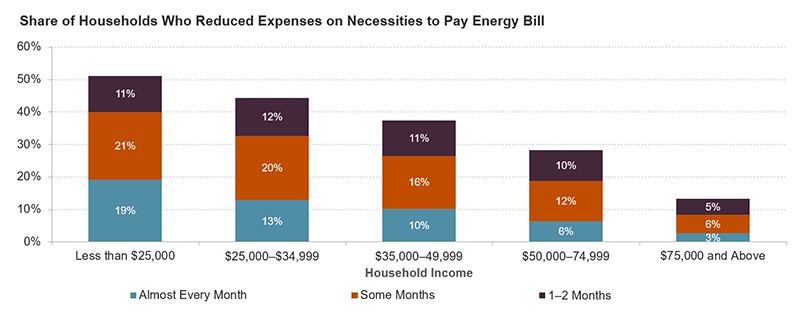

However, nearly all of these moratoriums expired by the end of 2021, leaving many more households at risk of energy insecurity, especially lower-income ones. In the first quarter of 2022, fully 51 percent of households earning less than $25,000 reported cutting back on basic necessities such as food or medicine to pay an energy bill at least once in the past year, according to Household Pulse Survey (HPS) data. This share was slightly higher for lower-income renters (53 percent) compared to lower-income homeowners (47 percent). Nearly 20 percent of all households earning less than $25,000 had to make this tradeoff almost every month in the year prior to Q1 2022 (Figure 1).

Figure 1. Lower-Income Households Struggled to Pay Energy Bills at the Beginning of 2022

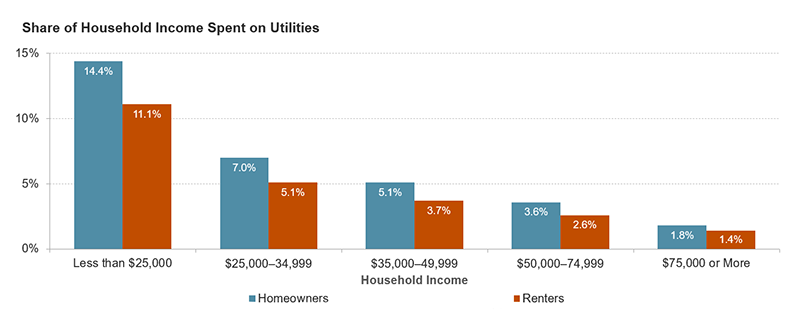

One possible reason behind households cutting back on necessities to pay their energy bills is a high energy burden (the share of household income spent on energy bills). In general, households spent about three percent of their income on electricity, natural gas, oil, or other fuels in 2021, according to American Community Survey (ACS) data. However, households earning less than $25,000 had an energy burden nearly four times higher, typically spending 12.6 percent of their income on these utilities. Homeowners in this income group had a median energy burden of 14.4 percent in 2021, and renter households (who pay utilities separately from rent) in this income group had a median energy burden of 11.1 percent (Figure 2).

Figure 2. Energy Burdens Were Particularly High for Lower-Income Homeowners in 2021

Energy prices are expected to increase this winter, primarily due to the war in Ukraine driving up the price of natural gas, which is used for 38 percent of the nation’s electricity generation as well as heat for almost half of US households last year. The Energy Information Administration expects wholesale electricity prices to be 20 to 60 percent higher this winter, with the highest prices in New England. These increases are already reaching utility customers: Eversource recently doubled the price of electricity in New Hampshire and National Grid recently implemented price increases of 64 percent for electricity and 24 percent for natural gas in Massachusetts.

Fortunately, there are both short-term and long-term policy solutions that can be used to address energy insecurity. The Biden administration recently announced $4.5 billion in additional funding for the Low-Income Home Energy Assistance Program (LIHEAP), which helps low-income households pay for energy bills and energy-related home repairs. There was also funding in two major pieces of legislation enacted in the past year that can help reduce energy insecurity in a longer timeframe. The Infrastructure Investment and Jobs Act (IIJA) passed in November 2021 contained an additional $3.5 billion for the Weatherization Assistance Program, which helps low-income households with energy efficiency retrofits including insulation and replacement of inefficient appliances. The Inflation Reduction Act passed in August 2022 included $9 billion for energy efficiency programs with extensive rebates targeted for low-income households and disadvantaged communities.

Policy tools are in use at the state level as well. While utility shut-off moratoriums instituted because of the pandemic have expired, 42 states have annual date- or temperature-based utility shut-off moratoriums. The date restrictions are most often for winter months and the temperature restrictions are typically below freezing or above 95 degrees. Very few of these orders apply to all utility customers, however, in contrast to the orders imposed due to the pandemic. Still, for eligible households in these states utility shut-off moratoriums can help avert the worst-case scenario this winter.

Given the substantial energy price spikes happening in parts of the country and the relatively large share of households experiencing energy insecurity at the beginning of this year, short-term supports and utility shut-off protections will be valuable tools to alleviate financial stress and protect the health of households. In the longer term, weatherizing homes to reduce energy usage and transitioning to cleaner energy that will not be prone to the same global supply disruptions as fossil fuels will be increasingly important for both households and the country.