A Year for the Record Books: The State of the Nation’s Housing in Perspective

It has been a record year for housing. Our latest State of the Nation’s Housing report highlights an eye-popping list of milestones that were set in 2024. Most relate to housing affordability or, more accurately, the lack of it. The challenges are evident across the country and are impacting renters, homeowners, and would-be homeowners alike.

Records related to the high costs of homebuying:

- The median existing home price hit a record high of $412,500, exceeding $400,000 for the first time.

- The nationwide home price-to-income ratio hit 5.0, tying the record from 2005.

- Of the top 100 metro areas, a record low of just 3 metros had a price-to-income ratio below 3.0.

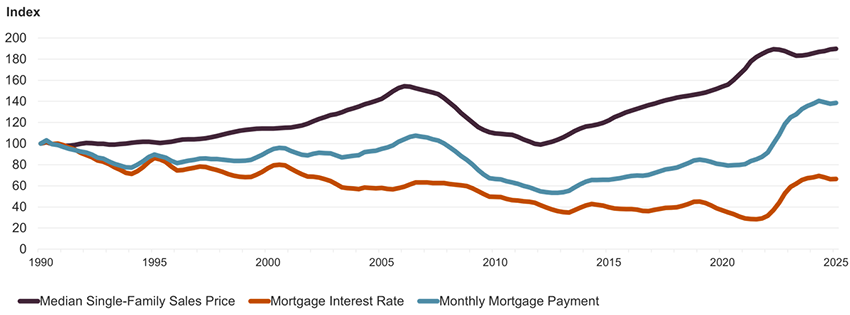

- The monthly mortgage payment on the median-priced home hit a record high of $2,560, roughly 40 percent higher than in 1990 even after adjusting for inflation (Figure 1).

Figure 1: The Costs of Homebuying Are at Record Highs

Notes: Payments and prices are adjusted for inflation using the CPI-U for All Items Less Shelter and a four-quarter rolling average. Monthly mortgage payments are on the median-priced home and assume a 3.5% downpayment on a 30-year fixed-rate loan and 0.55% mortgage insurance, 0.35% property insurance, and 1.15% property tax rates.

Source: JCHS tabulations of Freddie Mac, Primary Mortgage Market Surveys; National Association of Realtors (NAR), Existing Home Sales.

These high costs contributed to a record-breaking downturn in market activity including:

- The lowest number of existing home sales since 1995 (4.06 million).

- The first decline in the homeownership rate in 8 years (to 65.6 percent).

- A record-high median age for first-time buyers (38 years).

- A record-low rate of domestic moves (8.3 percent of households).

Additionally, even the ongoing affordability crisis for renters hit new records in 2023 including:

- A record number of renter households with cost burdens (paying more than 30 percent of incomes on housing) at 22.6 million.

- A record number of renter households with severe cost burdens (paying more than 50 percent of incomes on housing) at 12.1 million.

- A record low in the amount of income left after paying for housing ($250 per month) among renters earning less than $30,000 a year.

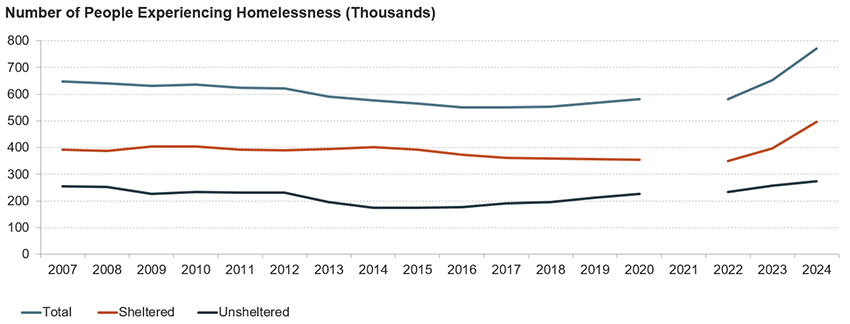

- A record-high number of people experiencing homelessness at 771,480 (Figure 2).

Figure 2: The Number of People Experiencing Homelessness Has Jumped to Unprecedented Levels

Note: Because of the pandemic, complete unsheltered counts were unavailable in January 2021 and sheltered counts were artificially low due to reduced shelter capacity.

Source: JCHS tabulations of HUD, Annual Homeless Assessment Report Point-in-Time Estimates.

Finally, the growing threat of damage and destruction from climate- and weather-related disasters resulted in:

- A record-high number of billion-dollar weather-related disasters over a two-year span (55).

Despite record-breaking levels of distress from high housing costs, the final chapter of the report details how critical federal housing assistance programs are facing the prospect of significant reductions in funding. Cuts in federal funding would result in substantially fewer households receiving help, given that more funding is needed each year to simply maintain current assistance levels. Already, the uncertainty is leading some public housing agencies to cancel waiting lists for assistance and hold back on issuing Section 8 vouchers. And with so many metrics of affordability pointing to an extreme crisis, pulling back assistance to those in need would likely add even further to the surprising number of records in this year’s report.