Interactive Map Shows Geographic Variation in Pandemic Financial Pressures

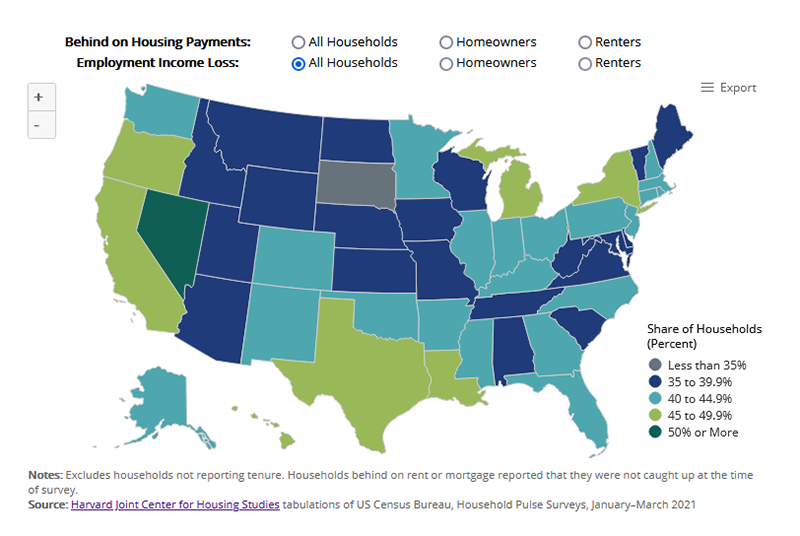

One year into the COVID-19 pandemic, 43 percent of all households reported they had lost employment income, and 12 percent had fallen behind on rent or mortgage payments. Moreover, as an interactive map released in conjunction with our 2021 State of the Nation’s Housing report shows, these financial impacts varied significantly across the country.

The Financial Pressures on Households Vary Considerably By State

In the first quarter of 2021, 38 percent of homeowner households and 53 percent of renter households reported they had lost employment income since March 2020. Income losses were geographically widespread; the states with highest shares of lost income were Nevada, California, Hawaii, Michigan, New York, Louisiana, Texas, and Oregon.

While geographically varied, income losses were more common in states with high shares of service industry jobs, as well as some states with more stringent shutdowns. The state with the highest share of households reporting employment income losses was Nevada, where over half of all households – including 47 percent of homeowner households and 63 percent of renter households – reported losing wages since the beginning of the pandemic (Figure 1). Nevada and Hawaii, which had among the highest shares of households reporting income losses, also had the two highest shares of employees working in the leisure and hospitality sector in February 2020, according to our tabulations of Bureau of Labor Statistics data. The leisure and hospitality sector had the most jobs lost of any sector early in the pandemic, accounting for 8.2 of the 22.4 million job losses in March and April 2020.

Figure 1: Income Losses Were Geographically Widespread in Early 2021

Households were also more likely to lose income in states like New York and California, with large, high-density cities, where the pandemic necessitated earlier and more restrictive shutdowns that limited nonessential work. In contrast, the states with the lowest shares of households reporting income losses, including South Dakota, Nebraska, Utah, and Idaho, tend to have lower population densities and were slower to enforce substantial shutdowns of economic activity.

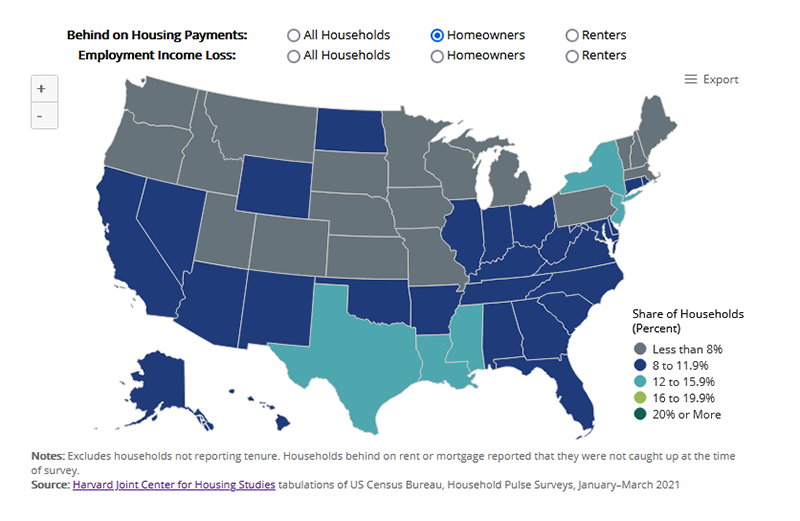

These income losses likely contributed to the 9 percent of homeowner households and 17 percent of renter households nationally that were behind on housing payments in early 2021. Despite some overlap, however, the states with high shares of households losing income were not the same as those with high shares of households behind on housing payments. For homeowners, the share behind on mortgage payments ranged from a low of 6 percent in Montana to a high of 14 percent in New York (Figure 2). The states where homeowners were most likely to fall behind on housing payments included high cost states on the East Coast like New York (14 percent) and New Jersey (13 percent), as well as states in the South where relatively high shares of homeowners had lower incomes, including Mississippi (14 percent), Louisiana (13 percent), and Texas (12 percent).

Figure 2: In Some States, as Many as 14 Percent of Homeowner Households Were Behind on Mortgage Payments

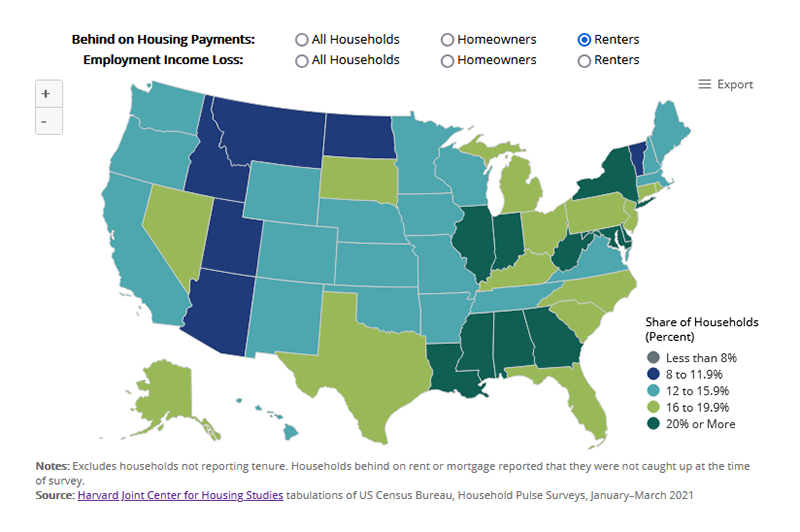

The states with the largest shares of renter households behind on payments were primarily in the South (Figure 3). In Mississippi, a staggering 27 percent of renter households were behind on rent in early 2021. And in Delaware, Louisiana, Alabama, and Georgia, more than one in five households were behind. Most of these states have low median incomes and among the highest shares of Black renter households, who already had high housing cost burdens and were disproportionately likely to lose income during the pandemic.

Figure 3: More Than a Fifth of Renter Households in Several States Were Behind on Rent in Early 2021

Although the share of households behind on housing payments declined somewhat in the first quarter of 2021, one out of every ten US homeowner households was still behind on mortgage payments and one out of every six renter households was still behind on rent during this period. These numbers may understate the extent of the financial hardships that households have experienced, even when those households are able to keep up with housing payments. Our recent paper on renter financial stress during the pandemic noted that about 25 to 40 percent of renter households tapped into savings and about a quarter borrowed from friends or family in order to keep paying rent. Moreover, the economic impact payments in December 2020 and March 2021 likely prevented even more households from falling behind on rent or mortgage, as 37 percent of households who received stimulus checks reported that some of the money was spent on housing costs.

Easing these financial hardships and preventing evictions and foreclosures will depend on the availability of housing assistance where it is most needed. In many states, funds from the COVID relief packages are taking significant time to reach those in need. At the end of May, states had spent just $1.5 billion of the $25 billion in rental assistance that had been allocated in January. In Mississippi, in late June, less than 2 percent of the $186 million available had been spent, with substantial disparities between counties.

When foreclosure protections and eviction moratoria expire, these households will potentially owe back months of mortgage and rent payments, which will be even more difficult to pay given the widespread income losses. Timely and sustained financial assistance, particularly in states where households were most impacted by the pandemic, will be critical to keep vulnerable homeowners and renters stably housed.