Pandemic to Weigh on Home Remodeling Spending Through Mid-Year 2021

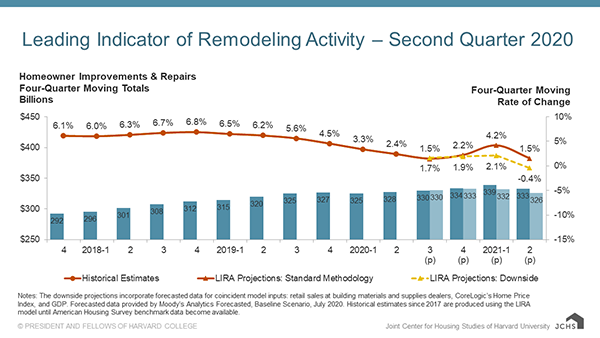

Expenditures for improvements and repairs to owner-occupied homes are expected to slow by the middle of next year as the COVID-19 pandemic continues to unfold, according to our latest Leading Indicator of Remodeling Activity (LIRA). Assuming continued weakness in the broader economy due to the public health crisis, the LIRA projects annual declines in renovation and repair spending of 0.4 percent by the second quarter of 2021. With the unprecedented changes to the US economy since mid-March, the Remodeling Futures Program is again providing this downside range for the home remodeling outlook, which incorporates forecasts for several core model inputs: retail sales of building materials, home prices, and GDP. In contrast, the LIRA’s standard methodology, which does not include forecasted trends, would have called for increasing remodeling activity through the start of next year.

The remodeling market was buoyed through the early months of the pandemic as owners spent a considerable amount of time at home and realized the need to update or reconfigure indoor and outdoor spaces for work, school, play, exercise, and more. However, sharp declines in home sales and project permitting activity this spring, as well as record unemployment, suggest many homeowners will likely scale back plans for major renovations this year and next.

As the pace of do-it-yourself activity, maintenance work, and exterior-focused projects begins to taper, annual expenditures by owners for home improvements and repairs are expected to shrink slightly to $326 billion by the middle of 2021. Given the ongoing uncertainty surrounding the broader impact of the pandemic, the timing on when we’ll reach a bottom in the remodeling market also remains unclear.

For more information, visit the LIRA page of our website.